Asked by marta kebede on May 09, 2024

Verified

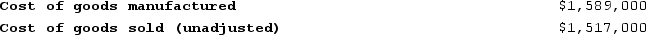

Tomlison Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year:  The journal entry to record the unadjusted Cost of Goods Sold is:

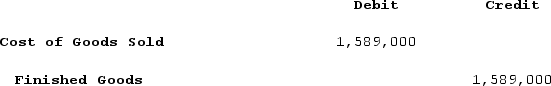

The journal entry to record the unadjusted Cost of Goods Sold is:

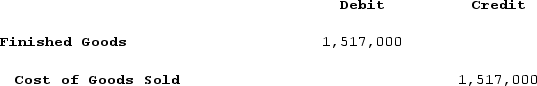

A)

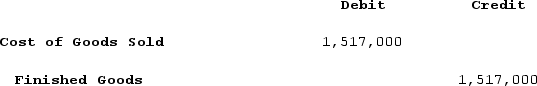

B)

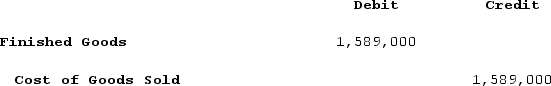

C)

D)

Job-Order Costing

A cost accounting system that assigns manufacturing costs to an individual product or batch of products, making the cost tracking process more manageable.

Unadjusted Cost Of Goods Sold

The initial recording of all costs associated with the goods sold by a company before any adjustments for returns, allowances, or discounts.

- Record and interpret journal entries for transactions specific to job-order costing.

Verified Answer

BJ

Billy J HamiltonMay 14, 2024

Final Answer :

B

Explanation :

The unadjusted Cost of Goods Sold for a job-order costing system is calculated as beginning work in process inventory plus total manufacturing costs minus ending work in process inventory. Using the data provided in the table, the calculation would be as follows:

Beginning work in process inventory: $0

Direct materials used: $534,000

Direct labor: $330,000

Manufacturing overhead: $360,000

Total manufacturing costs: $1,224,000

Ending work in process inventory: $144,000

Unadjusted Cost of Goods Sold: $1,080,000

Therefore, the journal entry to record the unadjusted Cost of Goods Sold would be:

Debit Cost of Goods Sold: $1,080,000

Credit Finished Goods Inventory: $1,080,000

Choice B is the correct option.

Beginning work in process inventory: $0

Direct materials used: $534,000

Direct labor: $330,000

Manufacturing overhead: $360,000

Total manufacturing costs: $1,224,000

Ending work in process inventory: $144,000

Unadjusted Cost of Goods Sold: $1,080,000

Therefore, the journal entry to record the unadjusted Cost of Goods Sold would be:

Debit Cost of Goods Sold: $1,080,000

Credit Finished Goods Inventory: $1,080,000

Choice B is the correct option.

Learning Objectives

- Record and interpret journal entries for transactions specific to job-order costing.

Related questions

Ruddick Corporation Is a Manufacturer That Uses Job-Order Costing ...

Southwick Company Uses a Job Order Costing System ...

Juarez Builders Incurred $285,000 of Labor Costs for Construction Jobs ...

Job Cost Sheets for Howard Manufacturing Are as Follows ...

The Entry to Record the Application of Overhead Is