Asked by Elmer Trejo on Jun 18, 2024

Verified

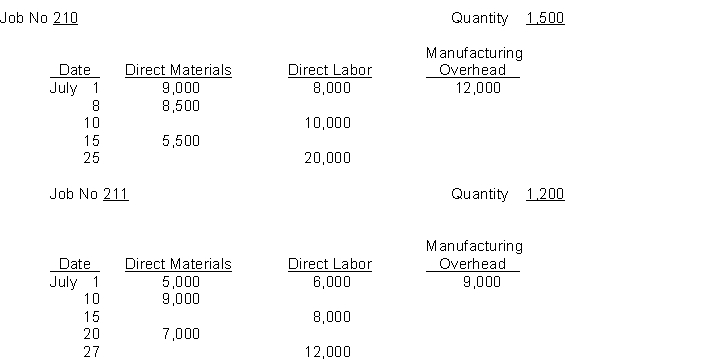

Job cost sheets for Howard Manufacturing are as follows:  Instructions

Instructions

(a) Answer the following questions.

1. What was the balance in Work in Process Inventory on July 1 if these were the only unfinished jobs?

2. What was the predetermined overhead rate in June if overhead was applied on the basis of direct labor cost?

3. If July is the start of a new fiscal year and the overhead rate is 20% higher than in the preceding year how much overhead should be applied to Job 210 in July?

4. Assuming Job 210 is complete what is the total and unit cost of the job?

5. Assuming Job 211 is the only unfinished job at July 31 what is the balance in Work in Process Inventory on this date?

(b) Journalize the summary entries to record the assignment of costs to the jobs in July. (Note: Make one entry in total for each manufacturing cost element.)

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated before the period begins based on estimated costs and activity levels.

Work in Process Inventory

is the account for materials and labor costs for products that are in the process of being manufactured but are not yet complete.

Direct Labor Cost

The expenses related to employees who directly manufacture a product or deliver a service, such as wages for factory workers.

- Record and interpret the financial transactions associated with the beginning and end of a job in a job order costing system.

Verified Answer

Job\text{ Job} Job 211−$5,000+$6,000+$9,000=20,000‾ 211-\$ 5,000+\$ 6,000+\$ 9,000=\underline{20,000} 211−$5,000+$6,000+$9,000=20,000

\quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad $49,000‾\underline{\$49,000}$49,000

2. Manufacturing overhead rate = 150% of direct labor cost ($12000 ÷ $8000

or $9000 ÷ $6000)

3. July overhead rate = 150% × 120% = 180%

Overhead applied in July = $30000 × 180% = $54000 4.

Direct materials$23,000 Direct labor 38,000 Manufacturing overhead ($12,000+$54,000)66,000 Total cost $127,000 Unit cost ($127,000÷1,500)$84,67\begin{array}{lr}\text { Direct materials}&\$23,000\\\text { Direct labor } & 38,000 \\\text { Manufacturing overhead }(\$ 12,000+\$ 54,000) & 66,000 \\\text { Total cost } & \$ 127,000 \\\text { Unit cost }(\$ 127,000 \div 1,500) & \$ 84,67\end{array} Direct materials Direct labor Manufacturing overhead ($12,000+$54,000) Total cost Unit cost ($127,000÷1,500)$23,00038,00066,000$127,000$84,67

5.

Direct materials $21,000 Direct labor 26,000 Manufacturing overhead ($9,000+$36,000)45,000 Total cost of work in process $92,000\begin{array}{lr}\text { Direct materials } & \$ 21,000 \\\text { Direct labor } & 26,000 \\\text { Manufacturing overhead }(\$ 9,000+\$ 36,000) & 45,000 \\\text { Total cost of work in process } & \$ 92,000\end{array} Direct materials Direct labor Manufacturing overhead ($9,000+$36,000) Total cost of work in process $21,00026,00045,000$92,000

(b)

Work in Process Inventory 30,000 Raw Materials Inventory 30,000 Work in Process Inventory 50,000 Factory Labor.50,000Work in Process Inventory 90,000 Manufacturing Overhead 90,000\begin{array}{llr} \text { Work in Process Inventory } &30,000\\ \text { Raw Materials Inventory } &&30,000\\\\ \text { Work in Process Inventory } &50,000\\ \text { Factory Labor.} &&50,000\\\\ \text {Work in Process Inventory } &90,000\\ \text { Manufacturing Overhead } &&90,000\\\end{array} Work in Process Inventory Raw Materials Inventory Work in Process Inventory Factory Labor.Work in Process Inventory Manufacturing Overhead 30,00050,00090,00030,00050,00090,000

Learning Objectives

- Record and interpret the financial transactions associated with the beginning and end of a job in a job order costing system.

Related questions

Tomlison Corporation Is a Manufacturer That Uses Job-Order Costing ...

Ruddick Corporation Is a Manufacturer That Uses Job-Order Costing ...

In the Excel, or Spreadsheet, Approach to Recording Financial Transactions ...

Journalize the Entries to Record the Following Transactions ...

Journalize the Entry to Record the Use of Materials and ...