Asked by Shalonda Lyons on Jul 09, 2024

Verified

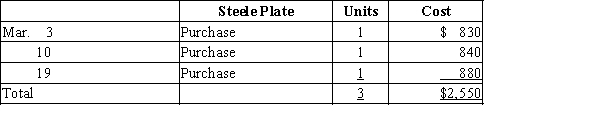

Three identical units of merchandise were purchased during March, as shown:  Assume that one unit is sold on March 23 for $1,125. Determine the gross profit for March and ending inventory on March 31 using (a) FIFO and (b) LIFO.

Assume that one unit is sold on March 23 for $1,125. Determine the gross profit for March and ending inventory on March 31 using (a) FIFO and (b) LIFO.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating how efficiently a company produces or buys its products.

Ending Inventory

The quantity and monetary value of unsold goods that a company has at the end of an accounting period, to be carried over as the beginning inventory of the next period.

FIFO

First-In, First-Out, an inventory management and valuation method where goods produced or acquired first are sold or used first.

- Assess the consequences of utilizing diverse inventory valuation approaches on financial statements.

Verified Answer

Ending Inventory

a.First-in, first-out (FIFO)$295 ($1,125 - $830)$1,720 ($840 + $880)b.Last-in, first-out (LIFO)$245 ($1,125 - $880)$1,670 ($830 + $840)c.Average cost

$2,550/3 = $850 avg. cost

$275 ($1,125 - $850)$1,700 ($850 × 2)

Learning Objectives

- Assess the consequences of utilizing diverse inventory valuation approaches on financial statements.

Related questions

Three Identical Units of Merchandise Were Purchased During May, as ...

Assume That Three Identical Units of Merchandise Are Purchased During ...

In a Period of Inflation the Cost Flow Method That ...

Under the Retail Inventory Method the Estimated Cost of Ending ...

Which Costing Method Cannot Be Used to Determine the Cost ...