Asked by Martin hubs-boy on Jul 19, 2024

Verified

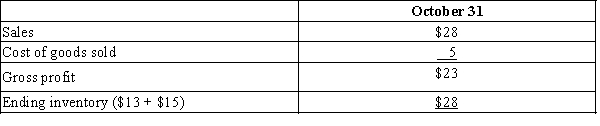

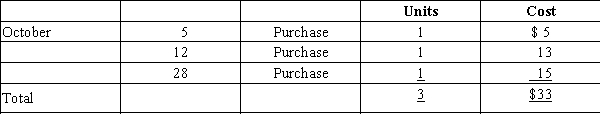

Assume that three identical units of merchandise are purchased during October, as follows:  Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the FIFO method.

FIFO

"First In, First Out," an inventory valuation method where the first items purchased or produced are the first ones sold, impacting the value of remaining inventory.

Gross Profit

The financial measure obtained by subtracting the cost of goods sold from total sales revenue.

Ending Inventory

The worth of products ready for sale at the close of a financial period, determined by adding acquisitions to the initial stock and then deducting the expense of the goods that were sold.

- Examine the effects of various inventory valuation techniques on financial statements.

Verified Answer

Learning Objectives

- Examine the effects of various inventory valuation techniques on financial statements.

Related questions

Three Identical Units of Merchandise Were Purchased During March, as ...

Three Identical Units of Merchandise Were Purchased During May, as ...

In a Period of Inflation the Cost Flow Method That ...

Under the Retail Inventory Method the Estimated Cost of Ending ...

Which Costing Method Cannot Be Used to Determine the Cost ...