Asked by Mario Alberto on Jun 04, 2024

Verified

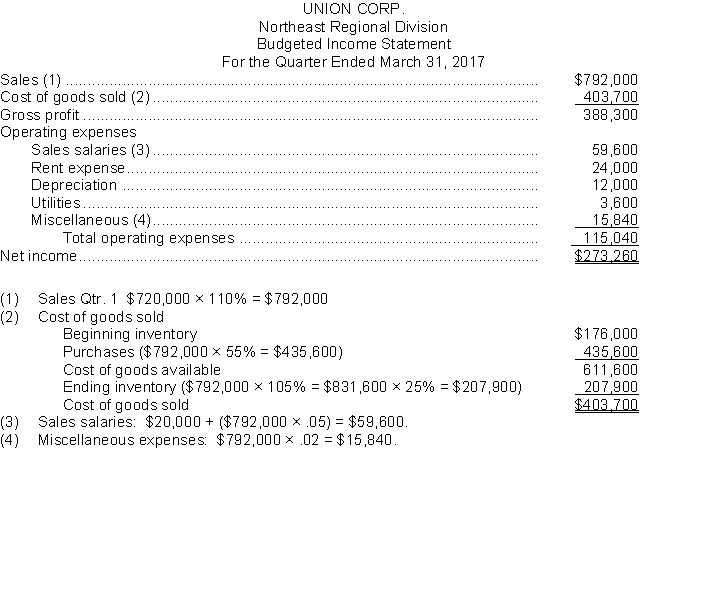

The Northeast Regional Division of Union Corp. has been requested to prepare a quarterly budgeted income statement for 2017. The regional manager expects that sales in the first quarter of 2017 will increase by 10% over the same quarter of the preceding year and will then increase by 5% for each succeeding quarter in 2017.

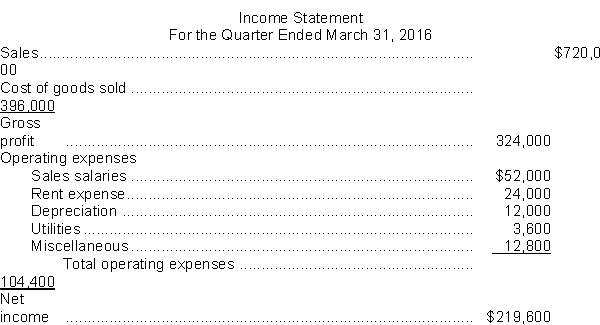

The corporate head office has requested that the regional manager maintain an inventory in dollars equal to 25% of the next quarter's sales. Quarterly purchases average 55% of quarterly sales. Budgeted ending inventory on December 31 2016 is $176000. Quarterly salaries are $20000 plus 5% of sales. All salaries are classified as sales salaries. Other quarterly expenses are estimated to be as follows: Rent expense $24,000 Depreciation on office equipment $12,000 Utilities expense $3,600 Miscellaneous expenses 2% of sales \begin{array}{lr}\text { Rent expense } & \$ 24,000 \\\text { Depreciation on office equipment } & \$ 12,000 \\\text { Utilities expense } & \$ 3,600 \\\text { Miscellaneous expenses } & 2 \% \text { of sales }\end{array} Rent expense Depreciation on office equipment Utilities expense Miscellaneous expenses $24,000$12,000$3,6002% of sales The income statement for the first quarter of 2016 was as follows:  Instructions

Instructions

Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2017. (Show computations.)

Quarterly Sales

The total revenue generated from sales within a specific three-month period in a fiscal year.

Miscellaneous Expenses

Costs that are not consistently categorized among the standard costs for operation of a business, often minor in scope and irregular in occurrence.

Rent Expense

Rent Expense is the cost incurred by a company for using a property or equipment for business operations, which is recognized on the income statement.

- Acquire knowledge of the essential principles and methodologies involved in the formulation of projected financial statements, including balance sheets and profit & loss statements.

- Distinguish between budgeting and long-range planning and their respective roles in organizational goal achievement.

Verified Answer

Learning Objectives

- Acquire knowledge of the essential principles and methodologies involved in the formulation of projected financial statements, including balance sheets and profit & loss statements.

- Distinguish between budgeting and long-range planning and their respective roles in organizational goal achievement.

Related questions

A Major Difference Between the Annual Budget and Long-Range Planning ...

In September 2016 the Budget Committee of Jason Company Assembles \[\begin{array} ...

In September 2016 the Management of Rye Company Assembles the ...

Which of the Following Includes the Cash Receipts and Cash ...

Which of the Following Shows the Schedule of Cash Payments ...