Asked by Melainah Alford on Jun 04, 2024

Verified

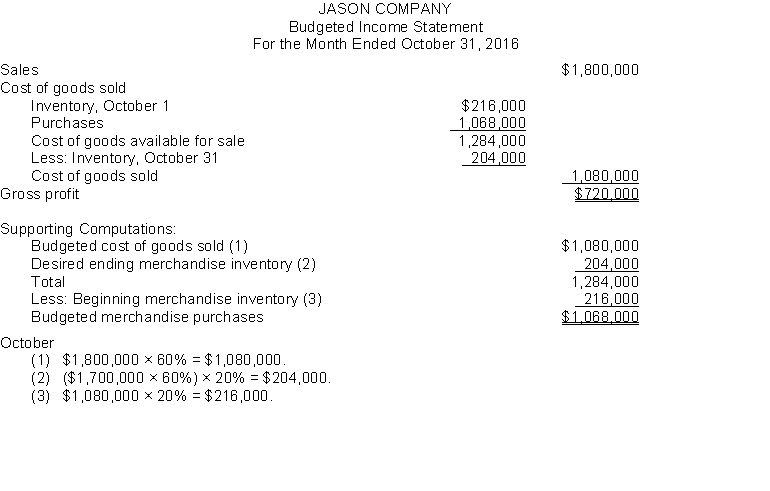

In September 2016 the budget committee of Jason Company assembles the following data:

1. Expected Sales October $1,800,000 November 1,700,000 December 1,600,000\begin{array} { l r } \text { October } & \$ 1,800,000 \\\text { November } & 1,700,000 \\\text { December } & 1,600,000\end{array} October November December $1,800,0001,700,0001,600,000

2. Cost of goods sold is expected to be 60% of sales.

3. Desired ending merchandise inventory is 20% of the next month's cost of goods sold.

4. The beginning inventory at October 1 will be the desired amount.

Instructions

Prepare the budgeted income statement for October through gross profit on sales including a cost of goods sold schedule.

Cost of Goods Sold

An expense representing the total cost of materials and labor directly associated with the production of goods sold by a business.

Merchandise Inventory

The goods a company intends to sell to customers that are considered current assets on the balance sheet.

Gross Profit

The difference between sales revenue and the cost of goods sold before deducting overheads, payroll, taxation, and interest payments.

- Apprehend the critical principles and approaches used in the creation of financial forecasts, specifically balance sheets and income statements.

- Compute and understand the importance of budgeted sales, cost of goods sold, and gross profit.

Verified Answer

Learning Objectives

- Apprehend the critical principles and approaches used in the creation of financial forecasts, specifically balance sheets and income statements.

- Compute and understand the importance of budgeted sales, cost of goods sold, and gross profit.

Related questions

In September 2016 the Management of Rye Company Assembles the ...

The Northeast Regional Division of Union Corp The Income Statement ...

Which of the Following Includes the Cash Receipts and Cash ...

Which of the Following Shows the Schedule of Cash Payments ...

A)Prepare a Classified Balance Sheet for Martin Air Freight Based ...