Asked by Shibuya Daemon on Apr 28, 2024

Verified

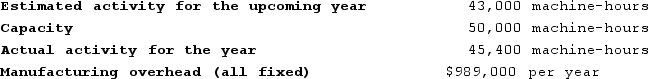

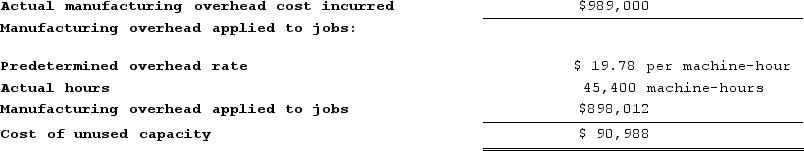

The management of Michaeli Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work.

Required:Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

Required:Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

Predetermined Overhead Rate

A rate used to allocate estimated overhead costs to products or job orders, based on a planned level of activity or driver.

Unused Capacity

Resources available for use that are not being employed in production, often representing inefficiency.

Estimated Activity

An approximation of the level of effort, production volume, or usage that forms the basis for budgeting and costing activities.

- Examine how idle capacity influences the rates and costs associated with overhead.

Verified Answer

Learning Objectives

- Examine how idle capacity influences the rates and costs associated with overhead.

Related questions

Schlaefer Corporation Is Conducting a Time-Driven Activity-Based Costing Study in ...

The Management of Krach Corporation Would Like to Investigate the ...

The Management of Krach Corporation Would Like to Investigate the ...

For Management Accounting Purposes, the Denominator Volume for Applying Overhead ...

Water Sports Ltd \frac{2}{3} % of the Regular Selling Price, and ...