Asked by Mithra Rathinappillai on Jun 24, 2024

Verified

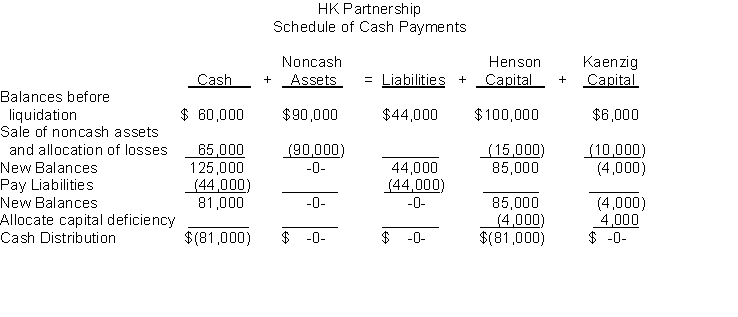

The HK Partnership is liquidated when the ledger shows: Cash $60,000 Noncash Assets 90,000 Liabilities 44,000 Howell, Capital 100,000 Kenton, Capital 6,000\begin{array} { l r } \text { Cash } & \$ 60,000 \\\text { Noncash Assets } & 90,000 \\\text { Liabilities } & 44,000 \\\text { Howell, Capital } & 100,000 \\\text { Kenton, Capital } & 6,000\end{array} Cash Noncash Assets Liabilities Howell, Capital Kenton, Capital $60,00090,00044,000100,0006,000 Henson and Kaenzig income ratios are 3:2 respectively.

Instructions

Prepare a schedule of cash payments assuming that the noncash assets were sold for $65000. Assume that any partner's capital deficiencies cannot be paid to the partnership.

Liquidation

The method of terminating a business and allocating its assets to those who have claims, typically happening when the business cannot pay its debts.

Noncash Assets

Assets owned by a business that are not cash, including property, equipment, and intellectual property.

Capital Deficiencies

Capital deficiencies occur when a company's financial resources and assets are not sufficient to cover its liabilities and debts.

- Acquire knowledge of the steps and accounting transactions pertaining to the termination of a partnership.

- Acquire knowledge about the idea of capital deficiency and the methods for its resolution under the partnership accounting paradigm.

Verified Answer

Learning Objectives

- Acquire knowledge of the steps and accounting transactions pertaining to the termination of a partnership.

- Acquire knowledge about the idea of capital deficiency and the methods for its resolution under the partnership accounting paradigm.

Related questions

In Liquidating a Partnership It Is Necessary to Convert ______________ ...

The ABC Partnership Is to Be Liquidated and You Have ...

The Zhuzer Company at December 31 Has Cash $50000 Noncash ...

Partners Randy and Mary Each Have $3,000 Capital Balances and ...

When a Partnership Is Liquidated, the Assets Are Sold and ...