Asked by Diana Morrissey on May 13, 2024

Verified

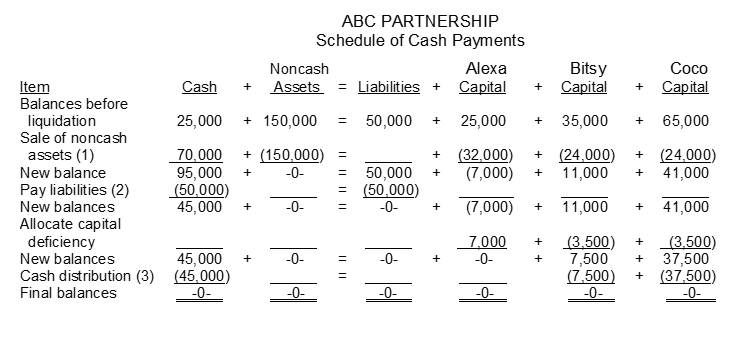

The ABC Partnership is to be liquidated and you have been hired to prepare a Schedule of Cash Payments for the partnership. Partners Alexa Bitsy and Coco share income and losses in the ratio of 4:3:3 respectively. Assume the following:

1. The noncash assets were sold for $70000.

2. Liabilities were paid in full.

3. The remaining cash was distributed to the partners. (If any partner has a capital deficiency assume that the partner is unable to make up the capital deficiency.)

Instructions

Using the above information complete the Schedule of Cash Payments below:

Liquidation

The process of converting assets into cash or cash equivalents by selling them, often used to pay off debts or in closing down a business.

Capital Deficiency

A financial situation where a company’s liabilities exceed its assets, indicating potential insolvency.

Schedule of Cash Payments

Schedule of Cash Payments is a detailed plan that outlines all expected cash payments to be made by a business over a specific period.

- Learn about the actions and ledger entries required in the process of dissolving a partnership.

- Understand the concept of capital deficiency and its resolution within the framework of partnership accounting.

Verified Answer

Learning Objectives

- Learn about the actions and ledger entries required in the process of dissolving a partnership.

- Understand the concept of capital deficiency and its resolution within the framework of partnership accounting.

Related questions

In Liquidating a Partnership It Is Necessary to Convert ______________ ...

The Zhuzer Company at December 31 Has Cash $50000 Noncash ...

The HK Partnership Is Liquidated When the Ledger Shows Henson ...

Which of the Following Is an Incorrect Step in the ...

The Sale of Assets for Liquidation Purposes of a Partnership ...