Asked by Laura Juarez on May 09, 2024

Verified

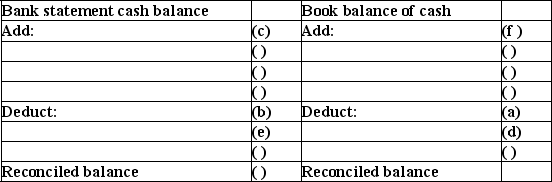

The following items a through f would cause Samson Company's book balance of cash to differ from its bank statement balance of cash.

a.A check printing charge imposed by the bank.

b.A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c.A deposit made on the last day of the month was not included on the bank statement.

d.A customer's check was returned for insufficient funds (NSF).

e.A check written in the current period has not yet been paid or returned by the bank.

f.A note receivable was collected by the bank and added to Samson's account.

Indicate where each item,letters a-f,would appear on Samson Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those shown on a bank statement to ensure consistency.

- Acquire knowledge about the reasons for and steps in the process of bank reconciliation.

Verified Answer

SS

Learning Objectives

- Acquire knowledge about the reasons for and steps in the process of bank reconciliation.

Related questions

The Following Information Is Available for the Savvy Company for ...

The Following Information Is Available to Reconcile Hinckley Company's Book ...

Umber Company's Bank Reconciliation for September Is Presented Below ...

A Bank Reconciliation Should Be Prepared ...

Gunnar Company Gathered the Following Reconciling Information in Preparing Its ...