Asked by Chynna Hughes on Jul 13, 2024

Verified

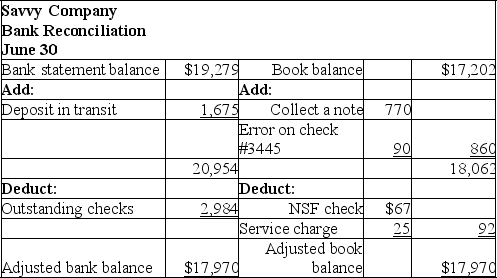

The following information is available for the Savvy Company for the month of June.

a.On June 30,after all transactions have been recorded,the balance in the company's Cash account has a balance of $17,202.

b.The company's bank statement shows a balance on June 30 of $19,279.

c.Outstanding checks at June 30 total $2,984.

d.The bank collected $770 on a note receivable that is not yet recorded by Savvy Company.

e.A $67 NSF check from a customer,J.Maroon is shown on the bank statement but not yet recorded by the company.

f.A deposit placed in the bank's night depository on June 30 totaling $1,675 did not appear on the bank statement.

g.Comparing the checks on the bank statement with the entries in the accounting records reveals that check #3445 for the payment of an account payable was correctly written for $2,450,but was recorded in the accounting records as $2,540.

h.Included with the bank statement was a bank service charge in the amount of $25 .It has not been recorded on the company's books.

1.Prepare the June bank reconciliation for the Savvy Company.

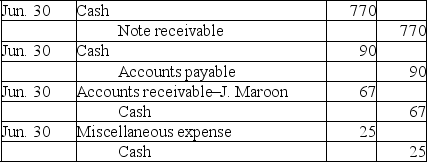

2.Prepare the general journal entries to bring the company's book balance of cash into conformity with the reconciled balance as of June 30.

NSF Check

A check that cannot be processed because the drawer's account does not have sufficient funds, standing for Non-Sufficient Funds.

Outstanding Checks

Checks that have been written and recorded in the issuing entity's records but have not yet been cashed or deposited by the recipient.

- Gain an understanding of the objectives and procedures involved in bank reconciliation.

- Formulate adjusting entries in the journal following a reconciliation statement.

- Acquire knowledge of different transaction categories and their implications for bank reconciliation.

Verified Answer

ZK

Learning Objectives

- Gain an understanding of the objectives and procedures involved in bank reconciliation.

- Formulate adjusting entries in the journal following a reconciliation statement.

- Acquire knowledge of different transaction categories and their implications for bank reconciliation.

Related questions

The Following Items a Through F Would Cause Samson Company's ...

Umber Company's Bank Reconciliation for September Is Presented Below ...

A Bank Reconciliation Should Be Prepared ...

The Following Information Is Available to Reconcile Hinckley Company's Book ...

Gunnar Company Gathered the Following Reconciling Information in Preparing Its ...

2.

2.