Asked by victoria burgos on Jul 02, 2024

Verified

The following information is available for Jergenson Company:

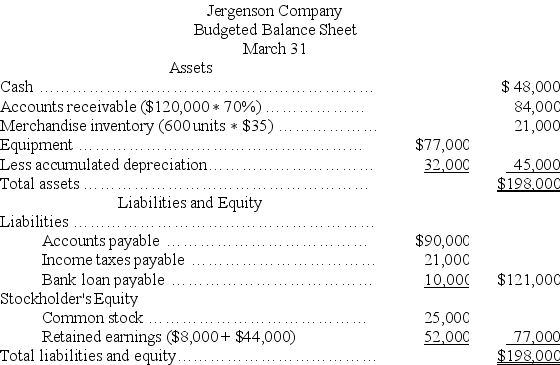

a.The Cash Budget for March shows a bank loan of $10,000 and an ending cash balance of $48,000.

b.The Sales Budget for March indicates sales of $120,000.Accounts receivable is expected to be 70% of March sales.

c.The Merchandise Purchases Budget indicates that $90,000 in merchandise will be purchased in March on account.Ending inventory for March is predicted to be 600 units at a cost of $35 per unit.Purchases on account are paid 100% in the month following the purchase.

d.The Budgeted Income Statement shows depreciation expense of $4,000,net income of $44,000 and $21,000 in income tax expense for the quarter ended March 31.Accrued taxes will be paid in April.

e.The Balance Sheet for February 28 shows equipment of $77,000 with accumulated depreciation of $28,000,common stock of $25,000 and retained earnings of $8,000.There are no changes budgeted in the equipment or common stock accounts for March

Prepare a budgeted balance sheet as of March 31.

Budgeted Balance Sheet

A financial statement projected for a future date, detailing the expected financial position of a company, including assets, liabilities, and equity.

Merchandise Purchases Budget

A financial plan that estimates the cost of goods a company needs to purchase to meet its sales goals.

Sales Budget

A financial plan that estimates the expected revenue from sales for a specific period, taking into account factors like market conditions, historical sales data, and economic forecasts.

- Absorb the intricacies involved in creating a master budget, highlighting the processes of sales estimation, oversight of cash receipts and disbursements, merchandise procurement, and the compilation of the budgeted income statement.

Verified Answer

Learning Objectives

- Absorb the intricacies involved in creating a master budget, highlighting the processes of sales estimation, oversight of cash receipts and disbursements, merchandise procurement, and the compilation of the budgeted income statement.

Related questions

The Master Budget Process Usually Begins with the Preparation of ...

The ________ Shows the Budgeted Costs for Factory Overhead That ...

________ Is a Budget System Based on Expected Activities and ...

Describe a Master Budget and the Sequence in Which the ...

Tsosie Corporation Makes One Product and It Provided the Following ...