Asked by Aerial Johnson on Jul 20, 2024

Verified

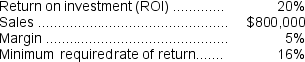

The following data pertains to Timmins Company's operations last year:  Required:

Required:

a.Compute the company's average operating assets.

b.Compute the company's residual income for the year.

Operating Assets

Resources used in the day-to-day functioning of a business that contribute to generating revenue.

Residual Income

The amount of income that exceeds the minimum return expected from a particular investment or operation.

- Measure and appraise the residual income.

Verified Answer

HC

hannah carpenterJul 22, 2024

Final Answer :

a.ROI = Margin × Turnover

20% = 5% × Turnover

Turnover = 20% ÷ 5% = 4

Turnover = Sales ÷ Average operating assets

4 = $800,000 ÷ Average operating assets

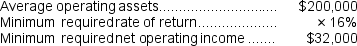

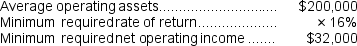

Average operating assets = $800,000 ÷ 4 = $200,000

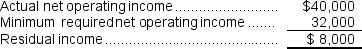

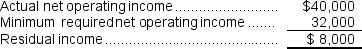

b.Before the residual income can be computed, we must first compute the company's net operating income for the year:

Margin = Net operating income ÷ Sales

5% = Net operating income ÷ $800,000

Net operating income = 5% × $800,000 = $40,000

20% = 5% × Turnover

Turnover = 20% ÷ 5% = 4

Turnover = Sales ÷ Average operating assets

4 = $800,000 ÷ Average operating assets

Average operating assets = $800,000 ÷ 4 = $200,000

b.Before the residual income can be computed, we must first compute the company's net operating income for the year:

Margin = Net operating income ÷ Sales

5% = Net operating income ÷ $800,000

Net operating income = 5% × $800,000 = $40,000

Learning Objectives

- Measure and appraise the residual income.