Asked by Carlos Paredes Monreal on May 31, 2024

Verified

The following data has been provided by Glasco Inc., a company that uses the FIFO method in its process costing system.The data concern the company's Shaping Department for the month of March.

Required:

Required:

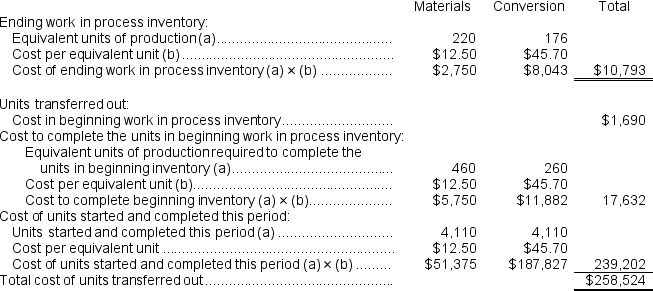

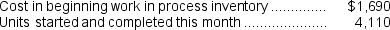

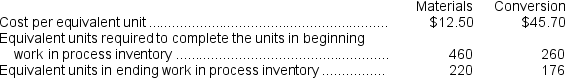

Determine the cost of ending work in process inventory and the cost of the units transferred out of the department during March using the FIFO method.

FIFO Method

First-In, First-Out method; an inventory valuation method where goods first purchased or produced are the first to be sold, used in accounting to calculate the cost of goods sold and ending inventory.

Ending Work

Also known as ending work in process, it refers to the value of goods still in production at the end of an accounting period.

Process Inventory

Inventories that are in various stages of production within the manufacturing process, also known as work in process inventory.

- Acquire knowledge on how to calculate the cost associated with ending inventory in work in process.

- Determine the cost related to units that are transferred from a department.

- Execute the First-In, First-Out principle in process costing scenarios.

Verified Answer

Learning Objectives

- Acquire knowledge on how to calculate the cost associated with ending inventory in work in process.

- Determine the cost related to units that are transferred from a department.

- Execute the First-In, First-Out principle in process costing scenarios.

Related questions

The Cost of Ending Work in Process Inventory in the ...

In February, One of the Processing Departments at Wyke Corporation ...

Department S Had 500 Units 60% Completed in Process at ...

In the Month of April a Department Had 500 Units ...

A Department Adds Materials at the Beginning of the Process \(\begin{array} ...