Asked by Duong Quoc Huy (K14_HL) on May 31, 2024

Verified

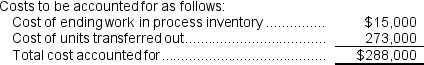

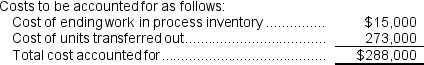

In February, one of the processing departments at Wyke Corporation had ending work in process inventory of $15,000.During the month, $264,000 of costs were added to production and the cost of units transferred out from the department was $273,000.The company uses the FIFO method in its process costing system.In the department's cost reconciliation report for February, the total cost to be accounted for would be:

A) $288,000

B) $576,000

C) $39,000

D) $552,000

FIFO Method

"First In, First Out" method, an inventory valuation approach where goods first added to the inventory are the first ones to be sold, affecting cost of goods sold and inventory valuation.

Cost Reconciliation

The process of analyzing and explaining the differences between the reported cost and the actual cost of manufacturing or production.

Work In Process

Stock comprising products that are currently being manufactured but are not yet finished.

- Ascertain the expense of units moved from a department.

- Examine the influence of initial and final inventories in process on the computation of equivalent units.

Verified Answer

HL

Helio LeyvaJun 02, 2024

Final Answer :

A

Explanation :

FIFO Method  Reference: APP05A-Ref1

Reference: APP05A-Ref1

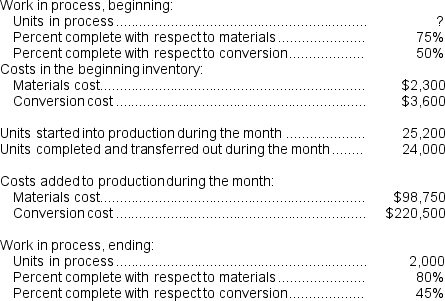

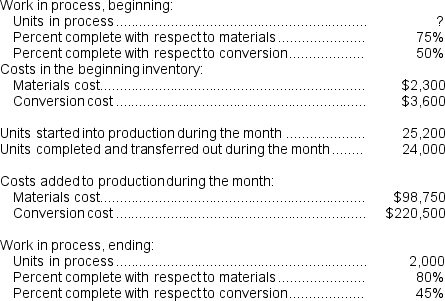

(Chapter 5S)Malmedy Corporation uses the FIFO method in its process costing system.The following data pertain to operations in the first processing department for a recent month:

Reference: APP05A-Ref1

Reference: APP05A-Ref1(Chapter 5S)Malmedy Corporation uses the FIFO method in its process costing system.The following data pertain to operations in the first processing department for a recent month:

Learning Objectives

- Ascertain the expense of units moved from a department.

- Examine the influence of initial and final inventories in process on the computation of equivalent units.