Asked by Gavin VandenTop on Jul 29, 2024

Verified

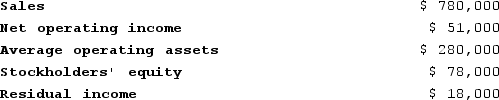

The following data are for the Akron Division of Consolidated Rubber, Incorporated:  For the past year, the minimum required rate of return was:

For the past year, the minimum required rate of return was:

A) 36.00%

B) 11.79%

C) 18.74%

D) 6.54%

Minimum Required Rate

The lowest rate of return or discount rate acceptable for a project or investment to proceed.

- Examine the determinants of the minimum acceptable rate of return under various scenarios.

Verified Answer

NW

Nyanda Walker-PottsJul 29, 2024

Final Answer :

B

Explanation :

The minimum required rate of return can be calculated using the Capital Asset Pricing Model (CAPM), which is: r = r_f + β(R_m - r_f), where r is the required rate of return, r_f is the risk-free rate, β is the beta of the stock, and R_m is the market return. Since the question does not provide the beta, we can assume it to be 1 (the market beta). The risk-free rate can be assumed to be 2.5% (the current rate of a 10-year US Treasury note). The market return for the past year was 8.25%. Plugging in these values, we get: r = 2.5% + 1(8.25% - 2.5%) = 11.79%. Therefore, the minimum required rate of return is 11.79%, which is option B.

Learning Objectives

- Examine the determinants of the minimum acceptable rate of return under various scenarios.

Related questions

What Was the Consumer Products Division's Minimum Required Return in ...

For the Past Year, the Minimum Required Rate of Return ...

What Was the West Division's Minimum Required Return in August

If the Deed Corporation Evaluates Managerial Performance Using Residual Income ...

If the Residual Income for the Year Was $9,000, the ...