Asked by Yessie Musah on May 20, 2024

Verified

If the residual income for the year was $9,000, the minimum required rate of return must have been:

A) 15%

B) 4%

C) 20%

D) 36%

Residual Income

The income that remains after deducting all operation and investment costs, including a minimum desired return on investment.

Required Rate of Return

The minimum annual percentage earned by an investment that will entice individuals or companies to put money into a particular project or investment.

- Calculate and interpret the minimum required rate of return.

Verified Answer

DB

Diane BurkeMay 23, 2024

Final Answer :

A

Explanation :

Residual income = Net operating income - (Average operating assets × Minimum required rate of return)

$9,000 = $36,000 - ($180,000 × Minimum required rate of return)

$180,000 × Minimum required rate of return = $36,000 - $9,000 = $27,000

$180,000 × Minimum required rate of return = $27,000

Minimum required rate of return = $27,000 ÷ $180,000 = 15%

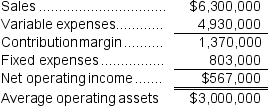

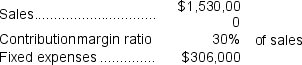

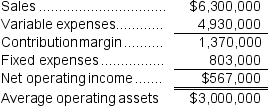

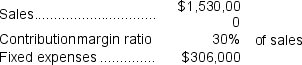

Reference: CH10-Ref12

Robichau Inc.reported the following results from last year's operations: At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 20%.

The company's minimum required rate of return is 20%.

$9,000 = $36,000 - ($180,000 × Minimum required rate of return)

$180,000 × Minimum required rate of return = $36,000 - $9,000 = $27,000

$180,000 × Minimum required rate of return = $27,000

Minimum required rate of return = $27,000 ÷ $180,000 = 15%

Reference: CH10-Ref12

Robichau Inc.reported the following results from last year's operations:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 20%.

The company's minimum required rate of return is 20%.

Learning Objectives

- Calculate and interpret the minimum required rate of return.

Related questions

If the Deed Corporation Evaluates Managerial Performance Using Residual Income ...

What Was the West Division's Minimum Required Return in August

The Minimum Required Rate of Return for the Past Year ...

For the Past Year, the Minimum Required Rate of Return ...

What Was the Consumer Products Division's Minimum Required Return in ...