Asked by Debbie Mezzich on Jun 01, 2024

Verified

The following account balances appear on the balance sheet of Osgood Industries:

Common Stock (300,000 shares authorized, $100 par): $10,000,000

Paid-In Capital in Excess of Par-Common Stock: $2,000,000

Retained Earnings: $45,000,000

The board of directors declared a 2% stock dividend when the market price of the stock was $135 a share.

Required:

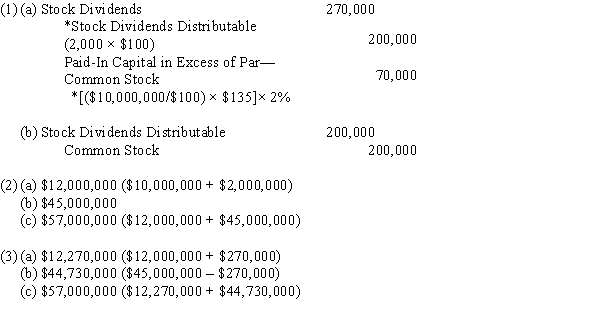

(1)Journalize the entries to record

(a)the declaration of the dividend, capitalizing an amount equal to market value

(b)the issuance of the stock certificates

(2)Determine the following amounts before the stock dividend was declared:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

(3)Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

Stock Dividend

A payment made to shareholders in the form of additional shares rather than cash, representing a portion of the profit.

Paid-In Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for stock, reflecting the funding provided to the company over and above the par value of the shares.

Retained Earnings

The portion of net income that is kept by a company rather than distributed to its shareholders as dividends, to be reinvested in the business or pay off debt.

- Understand and apply the accounting treatment for stock dividends.

- Prepare the stockholders' equity section of the balance sheet.

Verified Answer

Learning Objectives

- Understand and apply the accounting treatment for stock dividends.

- Prepare the stockholders' equity section of the balance sheet.

Related questions

Vincent Corporation Has 100,000 Shares of $100 Par Common Stock ...

Atkins Company Had 20,000 Shares of $5 Par Value Common ...

Katie Company Had 40,000 Shares of $2 Par Value Common ...

Which of the Following Correctly Describes the Effect of Declaring ...

On January 1 2017 Raleish Corporation Had $2000000 of $10 ...