Asked by Clarise Gindap on Jul 18, 2024

Verified

On January 1 2017 Raleish Corporation had $2000000 of $10 par value common stock outstanding that was issued at par and retained earnings of $1000000. The company issued 200000 shares of common stock at $12 per share on July 1. On December 15 the board of directors declared a 15% stock dividend to stockholders of record on December 31 2017 payable on January 15 2018. The market value of Raleish Corporation stock was $15 per share on December 15 and $16 per share on December 31. Net income for 2017 was $500000.

Instructions

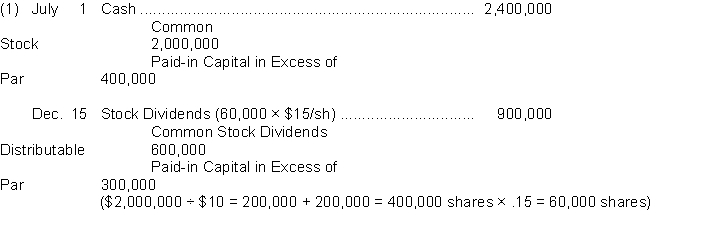

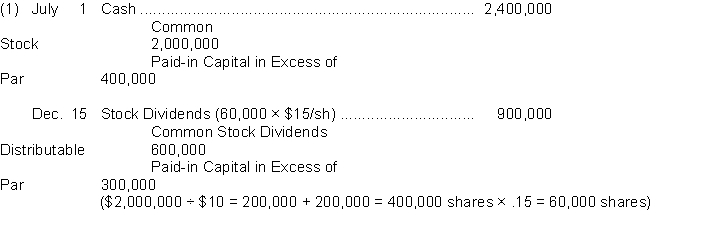

(1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15.

(2) Prepare the stockholders' equity section of the balance sheet for Raleish Corporation at December 31 2017.

Par Value Common Stock

The nominal or face value assigned to common stock shares in the corporation's charter, not necessarily reflecting their market value.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities; also known as shareholders' equity.

- Understand the accounting practices and effects related to stock dividends and cash dividends.

- Construct accounting records for the announcement and payment of dividends.

Verified Answer

DS

Destinee S RobinsonJul 25, 2024

Final Answer :  (2) Stockholders' equity Paid-in capital Capital stock

(2) Stockholders' equity Paid-in capital Capital stock

Common stock, $10 par value, 400,000 shares issued and outstanding $4,000,000 Common stock dividends distributable 600,000 Total capital stock 4,600,000 Additional paid-in capital in excess of par 700,000 Total paid-in capital 5,300,000 Retained earnings 600,000 Total stockholders’ equity 5,900,000\begin{array}{cr}\text {Common stock, \(\$ 10\) par value, 400,000 shares issued and }\\\text { outstanding }& \$ 4,000,000 \\\text { Common stock dividends distributable }& 600,000 \\\text { Total capital stock }& 4,600,000 \\\text { Additional paid-in capital in excess of par } & 700,000 \\\text { Total paid-in capital } & 5,300,000\\\text { Retained earnings } &600,000 \\\text { Total stockholders' equity } &\ 5,900,000\end{array}Common stock, $10 par value, 400,000 shares issued and outstanding Common stock dividends distributable Total capital stock Additional paid-in capital in excess of par Total paid-in capital Retained earnings Total stockholders’ equity $4,000,000600,0004,600,000700,0005,300,000600,000 5,900,000

(2) Stockholders' equity Paid-in capital Capital stock

(2) Stockholders' equity Paid-in capital Capital stockCommon stock, $10 par value, 400,000 shares issued and outstanding $4,000,000 Common stock dividends distributable 600,000 Total capital stock 4,600,000 Additional paid-in capital in excess of par 700,000 Total paid-in capital 5,300,000 Retained earnings 600,000 Total stockholders’ equity 5,900,000\begin{array}{cr}\text {Common stock, \(\$ 10\) par value, 400,000 shares issued and }\\\text { outstanding }& \$ 4,000,000 \\\text { Common stock dividends distributable }& 600,000 \\\text { Total capital stock }& 4,600,000 \\\text { Additional paid-in capital in excess of par } & 700,000 \\\text { Total paid-in capital } & 5,300,000\\\text { Retained earnings } &600,000 \\\text { Total stockholders' equity } &\ 5,900,000\end{array}Common stock, $10 par value, 400,000 shares issued and outstanding Common stock dividends distributable Total capital stock Additional paid-in capital in excess of par Total paid-in capital Retained earnings Total stockholders’ equity $4,000,000600,0004,600,000700,0005,300,000600,000 5,900,000

Learning Objectives

- Understand the accounting practices and effects related to stock dividends and cash dividends.

- Construct accounting records for the announcement and payment of dividends.

Related questions

On November 27 the Board of Directors of Beth Company ...

A Corporation Had Stockholders' Equity on January 1 as Follows ...

The Following Selected Transactions Took Place During the Current Year ...

Parlay Corporation Has 2,000,000 Shares of $0 ...

Vincent Corporation Has 100,000 Shares of $100 Par Common Stock ...