Asked by Jasneet Kaur Singh on Jul 12, 2024

Verified

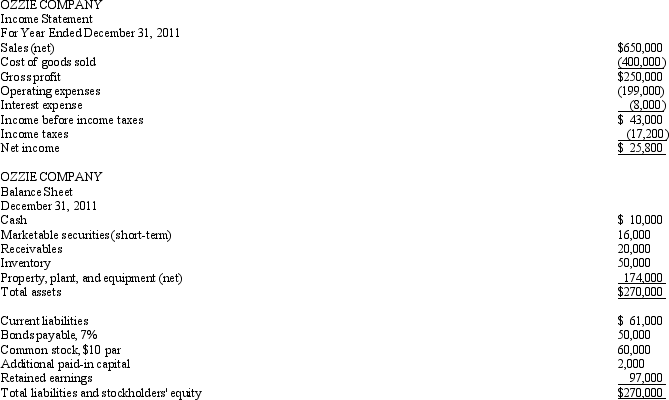

The financial statements for the Ozzie Company are presented below.

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:

The common stock was outstanding the entire year and is selling for $28 per share at year-end.The company has declared and paid dividends of $4.00 per share for the year.The income tax rate is 40%.Assume a business year of 360 days.Balances for certain items at December 31, 2010, were:

Inventory $48,000 Total assets 260,000 Total stockholders’ equity 157,200\begin{array}{lr}\text { Inventory } & \$ 48,000 \\\text { Total assets } & 260,000 \\\text { Total stockholders' equity } & 157,200\end{array} Inventory Total assets Total stockholders’ equity $48,000260,000157,200

Required:

Based on the data provided for Ozzie Company, compute the following ratios for 2011:

a. price/e arrings b. dividend yield c. profit margin d. return on total as sets e. current f. inventory turnover g. debt \begin{array}{ll}\text { a. } & \text { price/e arrings } \\\text { b. } & \text { dividend yield } \\\text { c. } & \text { profit margin } \\\text { d. } & \text { return on total as sets } \\\text { e. } & \text { current } \\\text { f. } & \text { inventory turnover } \\\text { g. } & \text { debt }\end{array} a. b. c. d. e. f. g. price/e arrings dividend yield profit margin return on total as sets current inventory turnover debt

Price/Earnings

A ratio used to value a company by dividing its current share price by its per-share earnings, indicating the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings.

Dividend Yield

An economic indicator that highlights the yearly amount a company distributes in dividends in comparison to its stock price.

Inventory Turnover

A financial metric that measures the rate at which a company sells and replaces its stock of goods over a period, indicating efficiency in sales and inventory management.

- Carry out calculations and expound on financial ratios, inclusive of price/earnings ratio, dividend yield, profit margin, return on total assets, current ratio, inventory turnover, and debt ratio.

Verified Answer

b. $4/$28=14.3%‾ \$ 4 / \$ 28=\underline{14.3 \%} $4/$28=14.3%

c. $25,800/$650,000=4.00%( rounded) ‾ \$ 25,800 / \$ 650,000=\underline{4.00 \%(\text { rounded) }} $25,800/$650,000=4.00%( rounded)

d. {$25,800+[$8,000−($8,000⋅0.4)]}/[($270,000+$260,000)/2]=11.5%‾ \quad\{\$ 25,800+[\$ 8,000-(\$ 8,000 \cdot 0.4)]\} /[(\$ 270,000+\$ 260,000) / 2]=\underline{11.5 \%} {$25,800+[$8,000−($8,000⋅0.4)]}/[($270,000+$260,000)/2]=11.5%

e. ($10,000+$16,000+$20,000+$50,000)/$61,000=1.57‾ (\$ 10,000+\$ 16,000+\$ 20,000+\$ 50,000) / \$ 61,000=\underline{1.57} ($10,000+$16,000+$20,000+$50,000)/$61,000=1.57 times

$400,000/[($48,000+$50,000)/2]=8.16‾ \$ 400,000 /[(\$ 48,000+\$ 50,000) / 2]=\underline{8.16} $400,000/[($48,000+$50,000)/2]=8.16 times

g. ($61,000+$50,000)/$270,000=41.7% \quad(\$ 61,000+\$ 50,000) / \$ 270,000=41.7 \% ($61,000+$50,000)/$270,000=41.7%

Learning Objectives

- Carry out calculations and expound on financial ratios, inclusive of price/earnings ratio, dividend yield, profit margin, return on total assets, current ratio, inventory turnover, and debt ratio.

Related questions

Listed Below Are a Number of Ratios, Followed by a ...

The Following Codes Are Used to Compute the Ratios Below \(\quad ...

Monroe Company Reported the Following Information for the Year Ended ...

What Was Lucas' Quality of Income Ratio

The Financial Statements of Flathead Lake Manufacturing Company Are Shown ...