Asked by Carol Jasso on May 31, 2024

Verified

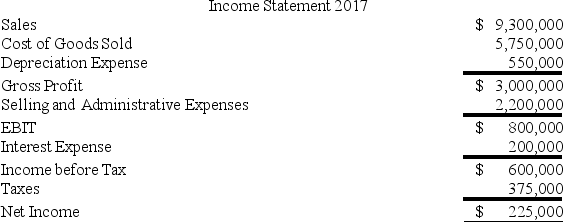

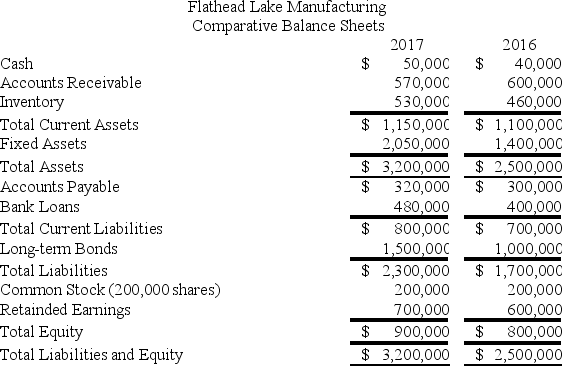

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

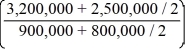

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's compound leverage ratio is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) 1.5

B) 2

C) 2.5

D) 3

Compound Leverage Ratio

A measure that assesses the impact of financial leverage on a company's potential returns, taking into account both debt and equity levels.

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period of time, revealing profit or loss.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time, showing the company's financial position.

- Analyze and comprehend financial ratios, focusing on liquidity, leverage, and profitability measures.

Verified Answer

= 2.51

= 2.51

Learning Objectives

- Analyze and comprehend financial ratios, focusing on liquidity, leverage, and profitability measures.

Related questions

Which One of the Following Ratios Is Used to Calculate ...

The Financial Statements of Flathead Lake Manufacturing Company Are Shown ...

The Financial Statements of Flathead Lake Manufacturing Company Are Shown ...

The Average Number of Times a Company's Inventory Is Sold ...

Company G Has a Ratio of Liabilities to Stockholders' Equity ...