Asked by Jamesetta Quiteh on May 29, 2024

Verified

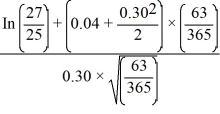

The current stock price of KMW is $27, the risk-free rate of return is 4%, and the standard deviation is 30%. What is the price of a 63-day call option with an exercise price of $25?

A) $2.50

B) $2.65

C) $2.89

D) $3.12

Risk-free Rate

The theoretical rate of return of an investment with zero risk of financial loss, typically represented by the yield on government securities.

Standard Deviation

A measure of the dispersion or variation in a set of values, often used in finance to assess the volatility of an investment.

Call Option

is a financial contract that gives the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset at a specified price within a specific time period.

- Understand the Black-Scholes model and its utilization in determining the prices of options.

Verified Answer

d1 =

= 0.7352

= 0.7352d2 = 0.7352 - 0.30 ×

= 0.6106

= 0.6106N(d1) = 0.7689

N(d2) = 0.7293

Call value = $2.65

Learning Objectives

- Understand the Black-Scholes model and its utilization in determining the prices of options.

Related questions

You Calculate the Black-Scholes Value of a Call Option as ...

In Order for a Binomial Option Price to Approach the ...

Calculate the Price of a Call Option Using the Black ...

Which of the Inputs in the Black-Scholes Option Pricing Model ...

According to the Black-Scholes Model, When the Exercise Price Is ...