Asked by Marie Brandt on Jun 29, 2024

Verified

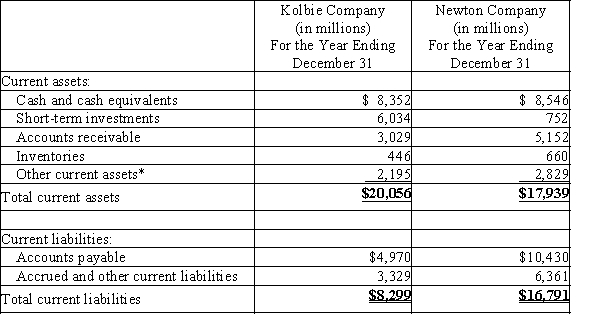

The current assets and current liabilities for Kolbie Company and Newton Company are as follows:  *These represent prepaid expenses and other non-quick current assets.

*These represent prepaid expenses and other non-quick current assets.

(a) Determine the quick ratio for both companies. Round to two decimal places.

(b) Interpret the quick ratio difference between the two companies.

Quick Ratio

A measure of a company’s ability to meet its short-term obligations using its most liquid assets, excluding inventory.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business’ normal operating cycle, whichever is longer.

Current Liabilities

Obligations that are due for payment within the next operating cycle or year, including accounts payable and short-term loans.

- Acquire insight into the quick ratio and its impact on a firm's financial fluidity.

Verified Answer

??

??????? ?????Jul 04, 2024

Final Answer :

(a) Quick Ratio = Quick Assets/Current LiabilitiesKolbie Company:Quick Ratio =

($8,352 + $6,034 + $3,029)/$8,299 = 2.10Newton Company:Quick Ratio =

($8,546 + $752 + $5,152)/$16,791 = 0.86

(b)It is clear that Kolbie's short-term liquidity is stronger than Newton's. Kolbie's quick ratio is 144% [

(2.10 - 0.86)/0.86] higher. Kolbie has a much stronger relative cash and short-term investment position than does Newton. Kolbie's cash and short-term investments are over 72% of total current assets

(173% of current liabilities), compared to Newton's 52% of total current assets

(55% of current liabilities). In addition, Newton's relative accounts payable position is larger than Kolbie's, indicating the possibility that Newton has longer supplier payment terms than does Kolbie. A quick ratio of 2.10 for Kolbie suggests ample flexibility to make strategic investments with its excess cash, while a quick ratio of 0.86 for Newton indicates an efficient but tight quick asset management policy.

($8,352 + $6,034 + $3,029)/$8,299 = 2.10Newton Company:Quick Ratio =

($8,546 + $752 + $5,152)/$16,791 = 0.86

(b)It is clear that Kolbie's short-term liquidity is stronger than Newton's. Kolbie's quick ratio is 144% [

(2.10 - 0.86)/0.86] higher. Kolbie has a much stronger relative cash and short-term investment position than does Newton. Kolbie's cash and short-term investments are over 72% of total current assets

(173% of current liabilities), compared to Newton's 52% of total current assets

(55% of current liabilities). In addition, Newton's relative accounts payable position is larger than Kolbie's, indicating the possibility that Newton has longer supplier payment terms than does Kolbie. A quick ratio of 2.10 for Kolbie suggests ample flexibility to make strategic investments with its excess cash, while a quick ratio of 0.86 for Newton indicates an efficient but tight quick asset management policy.

Learning Objectives

- Acquire insight into the quick ratio and its impact on a firm's financial fluidity.