Asked by chisom chikezie on Apr 28, 2024

Verified

The company's total asset turnover for Year 2 is closest to:

A) 5.29

B) 0.19

C) 1.04

D) 0.96

Total Asset Turnover

A financial ratio that measures a company's ability to generate sales from its assets by comparing sales to total assets.

- Calculate and analyze the company's total asset turnover.

Verified Answer

ZK

Zybrea KnightMay 02, 2024

Final Answer :

D

Explanation :

Total asset turnover = Sales ÷ Average total assets*

= $1,290,000 ÷ $1,340,000 = 0.96 (rounded)

*Average total assets = ($1,350,000 + $1,330,000)÷ 2 = $1,340,000

Reference: CH14-Ref10

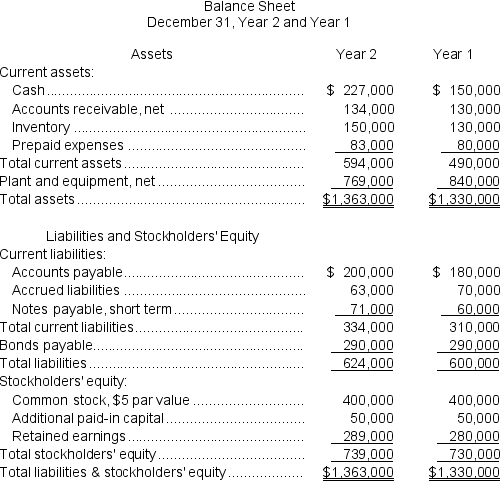

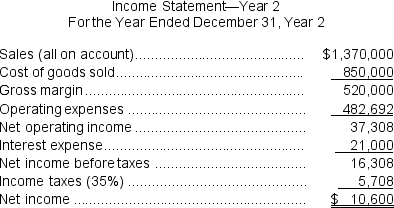

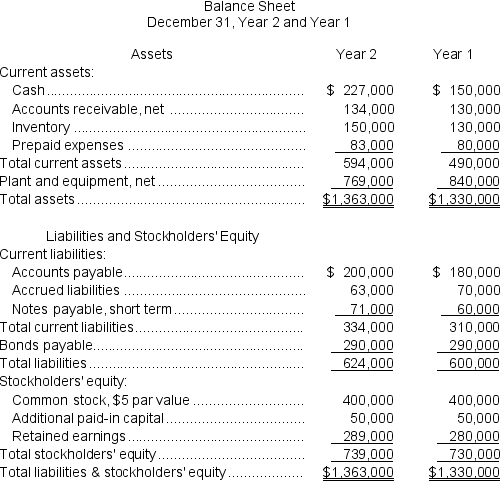

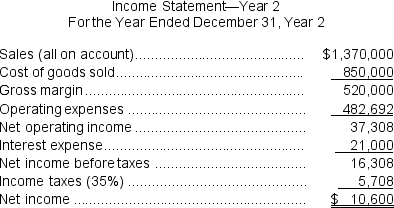

Dahn Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $1,600.The market price of common stock at the end of Year 2 was $2.37 per share.

Dividends on common stock during Year 2 totaled $1,600.The market price of common stock at the end of Year 2 was $2.37 per share.

= $1,290,000 ÷ $1,340,000 = 0.96 (rounded)

*Average total assets = ($1,350,000 + $1,330,000)÷ 2 = $1,340,000

Reference: CH14-Ref10

Dahn Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $1,600.The market price of common stock at the end of Year 2 was $2.37 per share.

Dividends on common stock during Year 2 totaled $1,600.The market price of common stock at the end of Year 2 was $2.37 per share.

Learning Objectives

- Calculate and analyze the company's total asset turnover.

Related questions

Deflorio Corporation's Inventory at the End of Year 2 Was ...

The Company's Total Asset Turnover for Year 2 Is Closest ...

Asset Turnover Is Computed by Dividing Net Sales by Average ...

Decision Makers and Other Users of Financial Statements Are Especially ...

Edmond Reported Average Total Assets of $9,965 Million and Net ...