Asked by Aparna Narayanan on Apr 28, 2024

Verified

The company's total asset turnover for Year 2 is closest to:

A) 1.17

B) 11.04

C) 0.09

D) 0.85

Total Asset Turnover

A financial ratio that measures a company's ability to generate sales from its assets by comparing net sales with average total assets.

Year 2

Typically refers to the second year of a particular time frame, such as a business plan, financial projections, or an academic calendar.

- Evaluate the company's total asset turnover to understand asset efficiency.

Verified Answer

JG

Jazmín GómesMay 01, 2024

Final Answer :

A

Explanation :

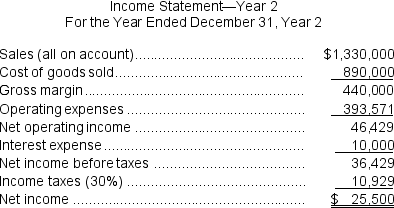

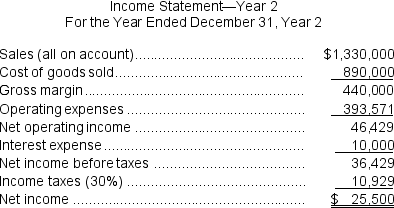

Total asset turnover = Sales ÷ Average total assets*

= $1,450,000 ÷ $1,243,000 = 1.17 (rounded)

*Average total assets = ($1,236,000 + $1,250,000)÷ 2 = $1,243,000

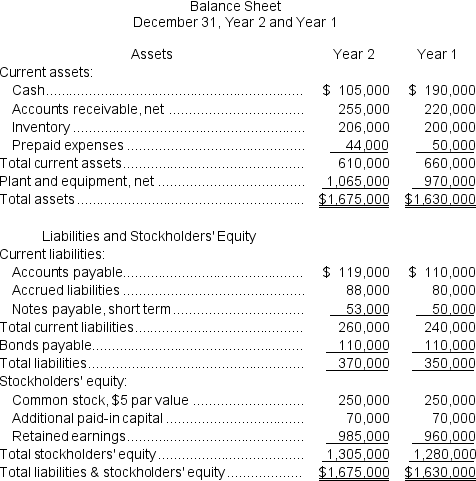

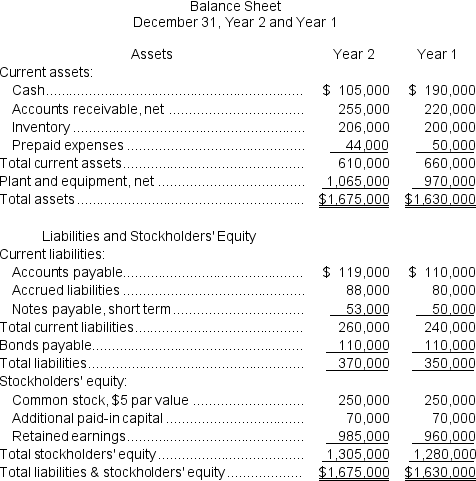

Reference: CH14-Ref12

Mahoe Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $500.The market price of common stock at the end of Year 2 was $8.06 per share.

Dividends on common stock during Year 2 totaled $500.The market price of common stock at the end of Year 2 was $8.06 per share.

= $1,450,000 ÷ $1,243,000 = 1.17 (rounded)

*Average total assets = ($1,236,000 + $1,250,000)÷ 2 = $1,243,000

Reference: CH14-Ref12

Mahoe Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $500.The market price of common stock at the end of Year 2 was $8.06 per share.

Dividends on common stock during Year 2 totaled $500.The market price of common stock at the end of Year 2 was $8.06 per share.

Learning Objectives

- Evaluate the company's total asset turnover to understand asset efficiency.