Asked by Emanuel Holesome on Jun 24, 2024

Verified

The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following:

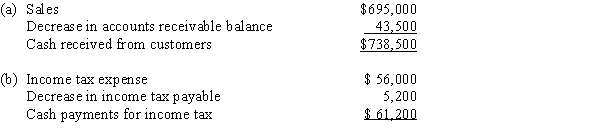

(a)If sales for the current year were $695,000 and accounts receivable decreased by $43,500 during the year, what was the amount of cash received from customers?

(b)If income tax expense for the current year was $56,000 and income tax payable decreased by $5,200 during the year, what was the amount of cash payments of income tax?

Accounts Receivable

Money owed to a company by customers for products or services that have been delivered or used but not yet paid for.

Income Tax Payable

This represents the amount of income tax that a company owes to the government but has not yet paid.

Sales

The transactions involving the exchange of goods or services for money, reflecting the primary revenue activity of a business.

- Determine the cash inflows and outflows associated with operating activities by employing both direct and indirect strategies.

- Quantify the cash acquired from customer sales and the cash spent on merchandise and operational expenditures.

Verified Answer

AR

Learning Objectives

- Determine the cash inflows and outflows associated with operating activities by employing both direct and indirect strategies.

- Quantify the cash acquired from customer sales and the cash spent on merchandise and operational expenditures.