Asked by Clara McNulty on Jun 01, 2024

Verified

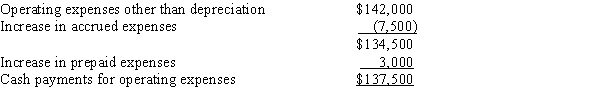

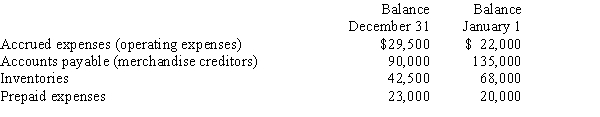

Selected data for the current year ended December 31 are as follows:  During the current year, the cost of goods sold was $620,000 and the operating expenses other than depreciation were $142,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.Determine the amount reported on the statement of cash flows for (a) cash payments for merchandise and (b) cash payments for operating expenses.

During the current year, the cost of goods sold was $620,000 and the operating expenses other than depreciation were $142,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.Determine the amount reported on the statement of cash flows for (a) cash payments for merchandise and (b) cash payments for operating expenses.

Direct Method

The direct method is a way of preparing the cash flow statement that involves listing all the major operating cash receipts and payments during the period, showing the net cash provided by operating activities.

Operating Expenses

Recurring expenses incurred through normal business operations, such as rent, utilities, and payroll, excluding COGS.

Cash Payments

Transactions that involve the direct transfer of money to settle obligations, including expenses, debts, or purchases, without the use of credit.

- Analyze the cash movements from business operations by leveraging both the direct and indirect techniques.

- Evaluate cash inflows received from customers against cash outflows for inventory purchases and operating outlays.

Verified Answer

IH

Learning Objectives

- Analyze the cash movements from business operations by leveraging both the direct and indirect techniques.

- Evaluate cash inflows received from customers against cash outflows for inventory purchases and operating outlays.

(b)

(b)