Asked by Khush Bhullar on Jul 14, 2024

Verified

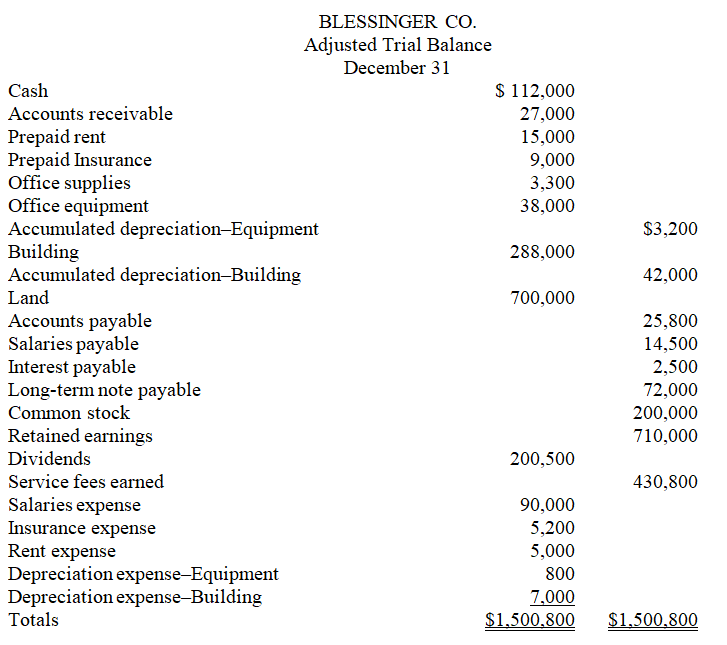

The calendar year-end adjusted trial balance for Blessinger Co. follows:

Required:

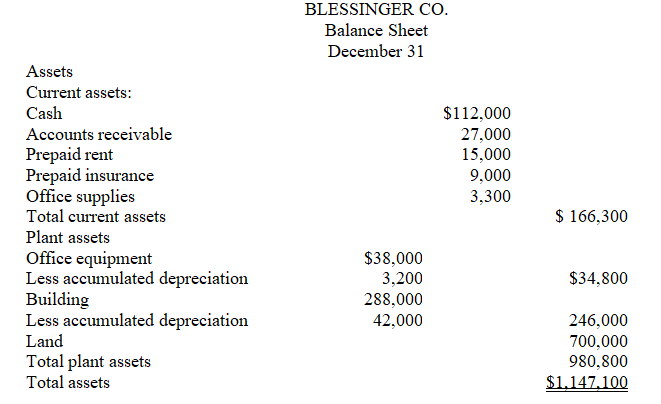

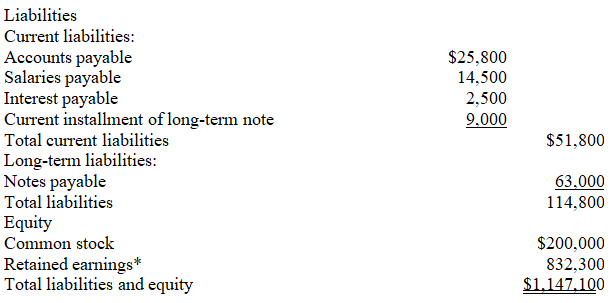

(a) Prepare a classified year-end balance sheet. (Note: A $9,000 installment on the long-term note payable is due within one year.)

(b) Prepare the required closing entries.

Classified Balance Sheet

A financial statement that groups assets, liabilities, and equity into categorized sections for easier analysis.

Closing Entries

Journal entries made at the end of an accounting period to transfer balances from temporary accounts to permanent accounts.

Long-term Note Payable

A debt obligation that is due for repayment beyond one year's time, representing a form of long-term financing.

- Appreciate the procedure and value of generating income statements and balance sheets.

- Comprehend the procedure and significance of making closing entries within the accounting cycle.

Verified Answer

*NI = $430,800 — $90,000 — $5,200 — $5,000 — $800 — $7,000 = $322,800

Ending Retained earnings = $710,000 + $322,800 — $200,500 = $832,300

Learning Objectives

- Appreciate the procedure and value of generating income statements and balance sheets.

- Comprehend the procedure and significance of making closing entries within the accounting cycle.

Related questions

The Unadjusted Trial Balance and the Adjustment Data for Porter ...

Using the Information Given Below,prepare an Income Statement and Statement ...

A)Prepare a Classified Balance Sheet for Martin Air Freight Based ...

The Calendar Year-End Adjusted Trial Balance for ...

Closing Entries Are Dated in the Journal as of ...