Asked by Conner Reiss on Jun 02, 2024

Verified

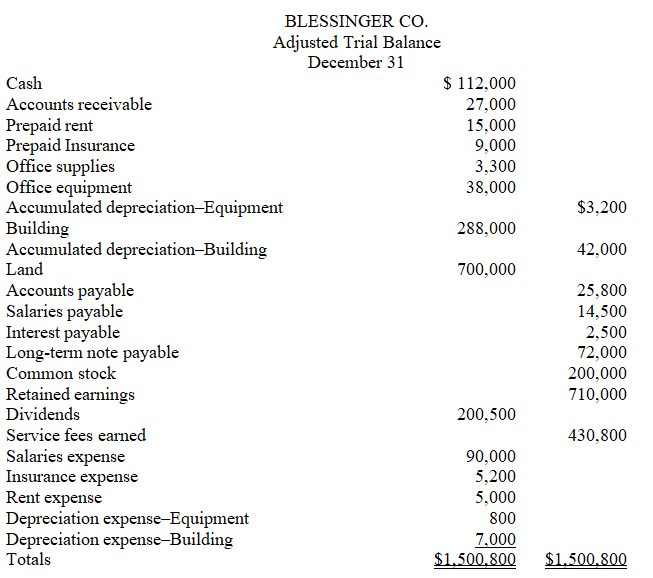

The calendar year-end adjusted trial balance for

Required:

(a)Determine the amounts of current assets and current liabilities.(Note: A $9,000 installment on the long-term note payable is due within one year.)

(b)Calculate the current ratio.Comment on the ability of Blessinger Co.to meets its short-term debts.

Current Assets

Assets expected to be converted into cash, sold, or consumed within a year or the operating cycle, whichever is longer.

Current Liabilities

Short-term financial obligations due within one year or within the normal operating cycle of the business, whichever is longer.

Current Ratio

The current ratio is a financial metric that measures a company's ability to pay short-term obligations with its short-term assets.

- Comprehend the methodology and importance of devising income statements and balance sheets.

- Determine critical financial proportions and elucidate their relevance.

Verified Answer

$112,000 + 27,000 + $15,000 + $9,000 + $3,300 = $166,300

Current liabilities = Accounts Payable + Salaries Payable + Interest Payable + Current Portion of Long-term Debt

$25,800 + 14,500 + $2,500 + $9,000 = $51,800

(b)$166,300/$51,800 = 3.2

Blessinger Co.has a current ratio of 3.2 to 1,which means it has more than three times the current assets as current liabilities.It should have no difficulty paying its short-term debts since cash alone is more than current liabilities.

Learning Objectives

- Comprehend the methodology and importance of devising income statements and balance sheets.

- Determine critical financial proportions and elucidate their relevance.

Related questions

The Following Information Is Available for Hatter Co ...

Using the Information Given Below,prepare an Income Statement and Statement ...

A)Prepare a Classified Balance Sheet for Martin Air Freight Based ...

Profit Margin = ________ Divided by Net Sales

The Unadjusted Trial Balance and the Adjustment Data for Porter ...