Asked by Louis Padilla on May 21, 2024

Verified

The Bravo Company manufactures a single product.On December 31,2012 Bravo adopted the dollar-value LIFO inventory method.The inventory on that date using the dollar-value LIFO inventory method was determined to be $500,000.Inventory data for succeeding years are as follows:

Year Ended December 31 Inventory at Respective Year-end Prices Relevant Price Index (Base Year 2012) 2012$500,0001.002013527,0001.082014635,0001.152015645,0001.21\begin{array}{rrr}\text { Year Ended December 31 } & \begin{array}{c}\text { Inventory at Respective } \\\text { Year-end Prices }\end{array} & \begin{array}{c}\text { Relevant Price Index } \\\text { (Base Year 2012) }\end{array}\\2012 & \$ 500,000 & 1.00 \\2013 & 527,000 & 1.08 \\2014 & 635,000 & 1.15 \\2015 & 645,000 & 1.21\end{array} Year Ended December 31 2012201320142015 Inventory at Respective Year-end Prices $500,000527,000635,000645,000 Relevant Price Index (Base Year 2012) 1.001.081.151.21

Required:

Compute the inventory amount at December 31,2013,2014,and 2015 using the dollar-value LIFO inventory method for each year.(Round all amounts to the nearest dollar.)

Dollar-Value LIFO

An inventory valuation method that uses the last-in-first-out (LIFO) principle, adjusted for changes in the dollar's value.

Relevant Price Index

An index that measures changes in the price level of a specific set of goods or services relevant to a particular context.

Inventory

The raw materials, work-in-process products, and finished goods that are considered to be the portion of a business's assets that are ready or will be ready for sale.

- Compute the value of inventory utilizing the dollar-value last-in, first-out approach.

- Examine the impact of different inventory valuation techniques on tax obligations and the book value of a firm.

Verified Answer

MC

Madison CogdillMay 26, 2024

Final Answer :

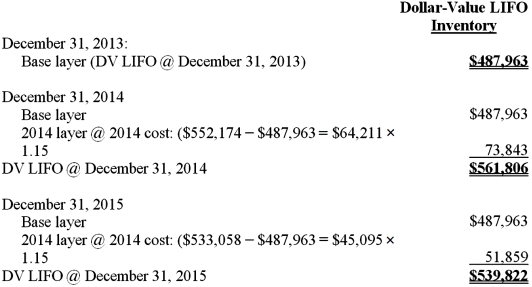

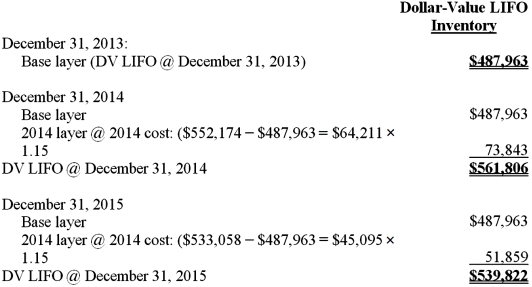

To compute ending inventory at base year prices,divide the year-end prices of each year by the respective price index,then separate the layers to compute ending inventory at LIFO Cost.Here are the computations: ( External Price Year Ended Inventory at Respective Index (Base Year Inventory at Base December 31 Year-end Prices 2012) Year (2012) Prices 2013$527,0001.08$487,9632014635,0001.15552,1742015645,0001.21533,058\begin{array}{rrrr}&&(\text { External Price }\\\text { Year Ended } & \text { Inventory at Respective } & \text { Index (Base Year } & \text { Inventory at Base } \\\text { December 31 } & \text { Year-end Prices } & \text { 2012) } & \text { Year (2012) Prices }\\2013 & \$ 527,000 & 1.08 & \$ 487,963 \\2014 & 635,000 & 1.15 & 552,174 \\2015 & 645,000 & 1.21 & 533,058\end{array} Year Ended December 31 201320142015 Inventory at Respective Year-end Prices $527,000635,000645,000( External Price Index (Base Year 2012) 1.081.151.21 Inventory at Base Year (2012) Prices $487,963552,174533,058

Notice that the base layer was partially depleted in 2013 and that the 2014 layer was partially depleted in 2015.

Notice that the base layer was partially depleted in 2013 and that the 2014 layer was partially depleted in 2015.

Notice that the base layer was partially depleted in 2013 and that the 2014 layer was partially depleted in 2015.

Notice that the base layer was partially depleted in 2013 and that the 2014 layer was partially depleted in 2015.

Learning Objectives

- Compute the value of inventory utilizing the dollar-value last-in, first-out approach.

- Examine the impact of different inventory valuation techniques on tax obligations and the book value of a firm.