Asked by Keiona Wedderburn on May 09, 2024

Verified

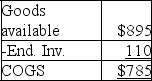

A company uses the periodic inventory system,and the following information is available.All purchases and sales are on credit.The selling price for the merchandise is $11 per unit.

Required:

Required:

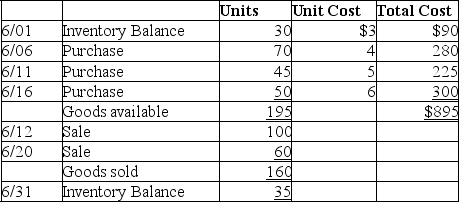

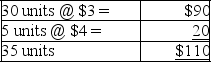

Determine the cost of the ending inventory and the cost of goods sold for June using the LIFO method.

Periodic Inventory System

An inventory system that updates the count and valuation of stock at specific intervals, rather than continuously.

LIFO Method

An inventory costing method that assumes the last items placed in inventory are sold first, used for both inventory valuation and cost of goods sold calculation.

Cost of Goods Sold

Costs directly related to the fabrication of goods a business sells, incorporating both materials and labor.

- Calculate the ending inventory and cost of goods sold using the LIFO method.

Verified Answer

SB

Learning Objectives

- Calculate the ending inventory and cost of goods sold using the LIFO method.

Cost of goods sold:

Cost of goods sold: