Asked by Pradnya S. Ghode on Jul 29, 2024

Verified

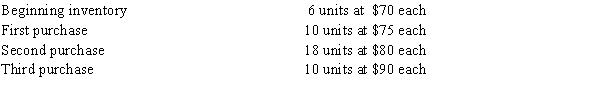

The beginning inventory and purchases of an item for the period were as follows:  The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost. Do not round your intermediate calculations. Round your final answer to two decimal places.

The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost. Do not round your intermediate calculations. Round your final answer to two decimal places.

Periodic System

An inventory tracking system that updates inventory balances after a specific period, based on physical inventory counts.

First-In

Often used in the context of inventory management, "First-In" refers to goods that were acquired or produced first being sold, used, or disposed of first.

Average Cost

A method of inventory valuation that determines the cost of goods sold and ending inventory based on the average cost of all similar items in inventory.

- Foster an understanding and skill in computing various inventory accounting formulas, such as FIFO, LIFO, and Average cost.

- Scrutinize the influence of inventory valuation methods on the calculation of goods sold cost, ending inventory valuation, and gross financial gain.

Verified Answer

Learning Objectives

- Foster an understanding and skill in computing various inventory accounting formulas, such as FIFO, LIFO, and Average cost.

- Scrutinize the influence of inventory valuation methods on the calculation of goods sold cost, ending inventory valuation, and gross financial gain.

Related questions

The Units of an Item Available for Sale During the ...

One Unit Is Sold on October 31 for $28 ...

Using the Table Provided, Calculate Total Sales, Cost of Goods ...

Brutus Corporation, a Newly Formed Corporation, Has the Following Transactions ...

Using the Table Provided, Calculate Total Sales, Cost of Goods ...

(b)

(b)  (c)

(c)