Asked by Saarthak Sharma on Jul 09, 2024

Verified

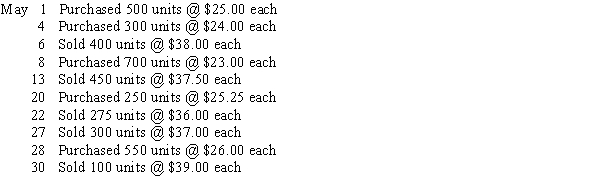

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.  Calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the following inventory methods:

Calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the following inventory methods:

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

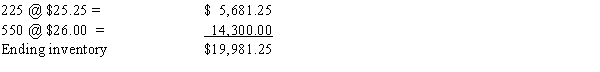

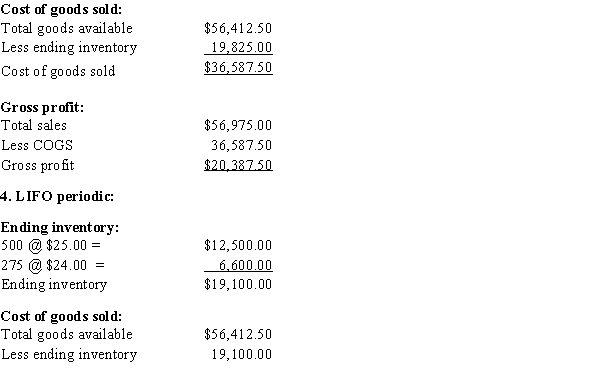

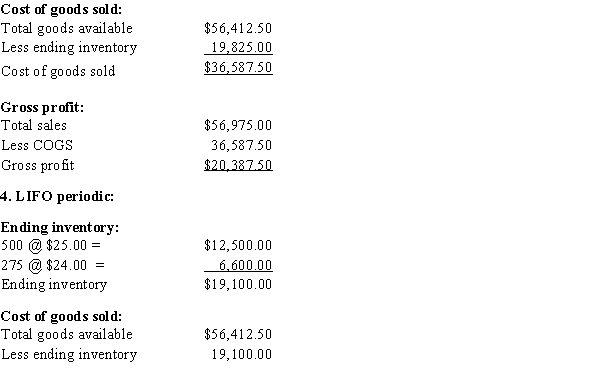

4. LIFO periodic

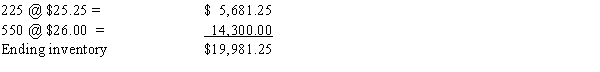

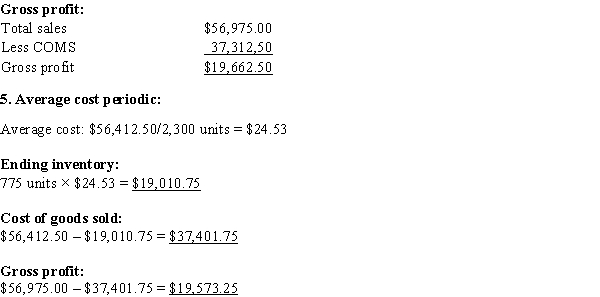

5. Average cost periodic (round average to nearest cent)

FIFO Perpetual

A method of inventory valuation where goods are sold based on the order they were acquired, constantly updated to reflect transactions in real time.

LIFO Periodic

An inventory valuation method where the last items to be added to inventory are the first ones to be removed, applied at the end of an accounting period.

Average Cost

refers to the total cost of production divided by the number of units produced, also known as unit cost.

- Learn to interpret and calculate various methodologies in inventory accounting, including FIFO, LIFO, and Average cost.

- Investigate the implications of employing diverse inventory valuation strategies on the cost of goods sold, ending stock, and gross income.

Verified Answer

SS

Syafiqah SalmanJul 13, 2024

Final Answer :

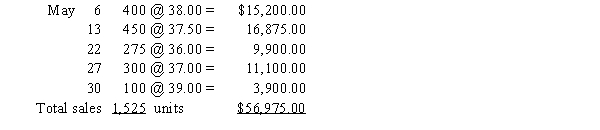

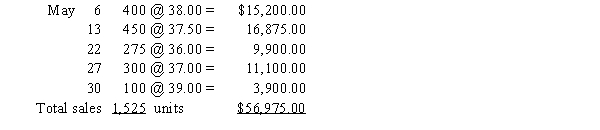

Total sales (not dependent on inventory method):  Total merchandise available for sale:

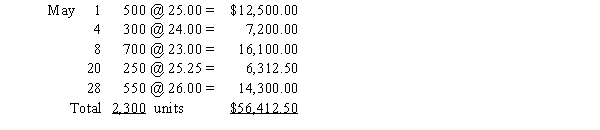

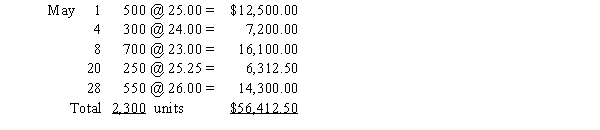

Total merchandise available for sale:

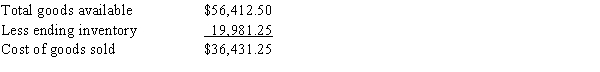

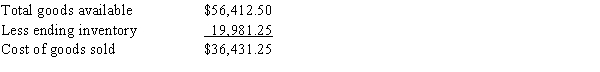

1. & 2. FIFO perpetual, FIFO periodic:

There is no difference between these methods since FIFO is always first-in, first-out.Ending inventory:

Total units - Units sold = Ending inventory units

2,300 - 1,525 = 775 units Cost of goods sold:

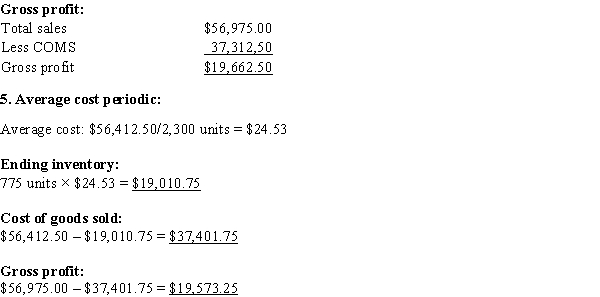

Cost of goods sold:  Gross profit:

Gross profit:

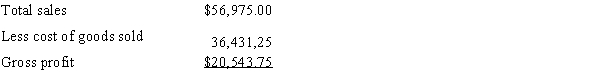

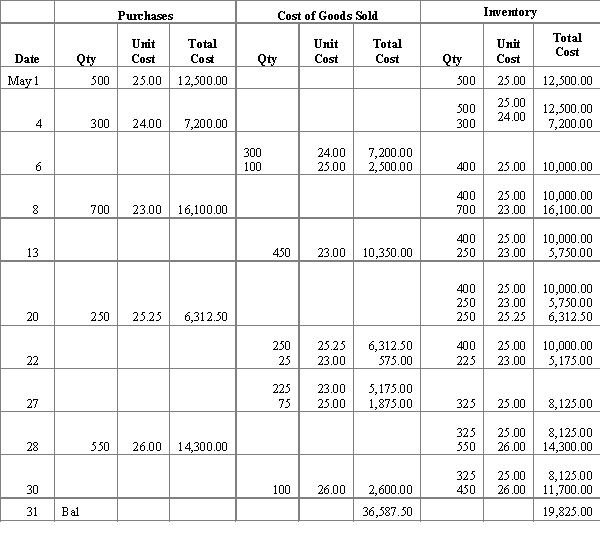

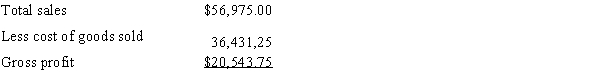

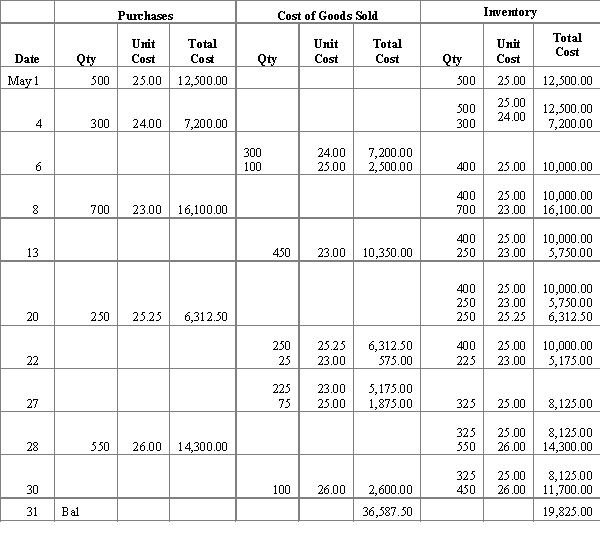

3. LIFO perpetual:

Cost of goods sold

Cost of goods sold

$37,312.50

Total merchandise available for sale:

Total merchandise available for sale:

1. & 2. FIFO perpetual, FIFO periodic:

There is no difference between these methods since FIFO is always first-in, first-out.Ending inventory:

Total units - Units sold = Ending inventory units

2,300 - 1,525 = 775 units

Cost of goods sold:

Cost of goods sold:  Gross profit:

Gross profit:

3. LIFO perpetual:

Cost of goods sold

Cost of goods sold$37,312.50

Learning Objectives

- Learn to interpret and calculate various methodologies in inventory accounting, including FIFO, LIFO, and Average cost.

- Investigate the implications of employing diverse inventory valuation strategies on the cost of goods sold, ending stock, and gross income.