Asked by Alanna Davis on Jul 13, 2024

Verified

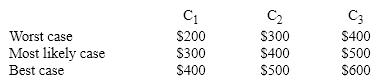

The Basalt Corporation is considering a new venture. Management has made the following cash flow estimates for the project over the next three years under assumptions reflecting best, worst, and most likely scenarios in each year.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Cash Flow Estimates

Forecasts of cash inflows and outflows anticipated for a business during a particular time frame.

NPVs

Net Present Values, plural; the calculation of multiple investments' profitability by discounting future cash flows to their present values and comparing them to the initial investment.

Scenarios

In finance and planning, scenarios represent different potential future states or outcomes, used to evaluate the impact of varying conditions on projects or investments.

- Differentiate among various scenarios (optimal, least favorable, and most probable) in the assessment of projects.

- Calculate the risk-adjusted NPV of projects using appropriate discount rates and compare different project outcomes.

Verified Answer

CFo=-1,000, C01=400, C02=500, C03=600; NPV: I=12

NPV=183

Probability = .25x.25x.25=.015625

Most likely case

CFo=-1,000, C01=300, C02=400, C03=500; NPV: I=12

NPV=-57

Probability = .5x.5x.5 = .125000

Worst case

CFo=-1000, C01=200, C02=300, C03=400; NPV: I=12

NPV=-298

Probability = .25x.25x.25=.015625

Learning Objectives

- Differentiate among various scenarios (optimal, least favorable, and most probable) in the assessment of projects.

- Calculate the risk-adjusted NPV of projects using appropriate discount rates and compare different project outcomes.

Related questions

Francis Corp Is Evaluating a Capital Budgeting Project and Has ...

Which of the Following Is the Appropriate Discount Rate to ...

Scenario and Sensitivity Analysis Are Helpful in Determining Which Variables ...

The Type of Analysis That Is Most Dependent Upon the ...

An Analysis Which Combines Scenario Analysis with Sensitivity Analysis Is ...