Asked by Katherine Roman on May 17, 2024

Verified

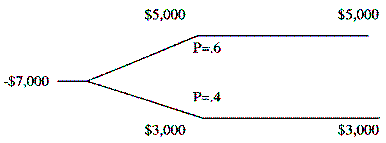

Francis Corp is evaluating a capital budgeting project and has come up with the following two branch decision tree analysis ($000). The firm's cost of capital is 12%. What is the project's NPV?

Branch Decision Tree Analysis

A systematic, graphical approach to evaluating all possible alternatives in decision-making, representing outcomes, resources, costs, and utility.

Cost of Capital

A rephrasing: The minimum return that a company must earn on existing asset base to satisfy its creditors, owners, and other providers of capital.

NPV

Net Present Value; a calculation used to assess the value of a project or investment by determining the present value of future cash flows.

- Understand the application and consequences of decision tree analysis when assessing capital budgeting projects.

- Assess the adjusted net present value (NPV) of projects, employing proper discount rates, and analyze the outcomes of distinct projects.

Verified Answer

Upper Path: CFo=-7000, C01=5000, C02=5000; NPV: I=12

NPV = 1450

Lower Path: CFo=-7000, C01=3000, C02=3000; NPV: I=12

NPV = -1930

Project NPV = .6(1450) - .4(1930) = 870 - 772 = $98

Learning Objectives

- Understand the application and consequences of decision tree analysis when assessing capital budgeting projects.

- Assess the adjusted net present value (NPV) of projects, employing proper discount rates, and analyze the outcomes of distinct projects.

Related questions

The Basalt Corporation Is Considering a New Venture ...

Which of the Following Is the Appropriate Discount Rate to ...

The Cost of Capital Is the Average Rate of Return ...

The Immediate Cash Outflow Required for This Project Would Be

When Using Internal Rate of Return to Evaluate Investment Projects ...