Asked by Vincent Zhang on Jul 22, 2024

Verified

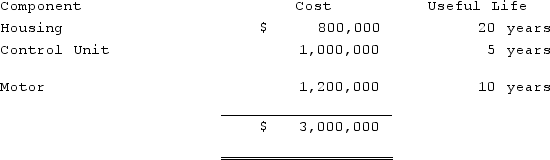

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

U.S. GAAP

In the United States, the Generally Accepted Accounting Principles represent a standard set of guidelines for financial accounting.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Straight-Line Method

A depreciation technique that allocates an equal portion of an asset's cost to each year of its useful life.

- Comprehend the principal distinctions between IFRS and U.S. GAAP regarding financial reporting and depreciation techniques.

- Understand the components method of depreciation as applied in both IFRS and U.S. GAAP.

- Comprehend the impact of corporate policies on the accounting practices of subsidiaries, particularly in relation to depreciation.

Verified Answer

MM

Learning Objectives

- Comprehend the principal distinctions between IFRS and U.S. GAAP regarding financial reporting and depreciation techniques.

- Understand the components method of depreciation as applied in both IFRS and U.S. GAAP.

- Comprehend the impact of corporate policies on the accounting practices of subsidiaries, particularly in relation to depreciation.

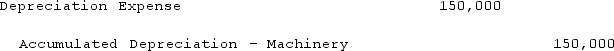

$3,000,000 ÷ 20 = $150,000

$3,000,000 ÷ 20 = $150,000