Asked by shadyra basurto on Jul 04, 2024

Verified

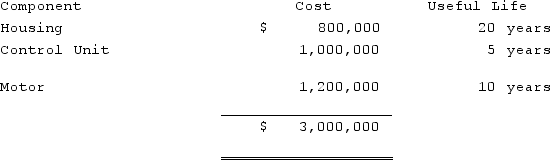

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.

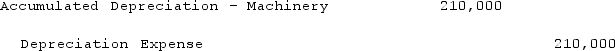

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry to convert the 2020 Teapot, Ltd. financial statements from IFRS to U.S. GAAP.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that is used globally.

U.S. GAAP

United States Generally Accepted Accounting Principles, which are a set of rules and standards for financial reporting and accounting practices in the U.S.

Straight-Line Method

A method of calculating depreciation of an asset by evenly spreading the cost over its useful life.

- Learn how to prepare journal entries for the conversion of financial statements from IFRS to U.S. GAAP.

- Understand the corporate policy implications on subsidiary accounting practices, especially concerning depreciation.

Verified Answer

KA

Kristen AzanaJul 05, 2024

Final Answer :  According to U.S. GAAP rules applied to Teapot Corp., both Accumulated Depreciation - Machinery and Depreciation Expense are overstated by $210,000; therefore, the entry to convert Teapot, Ltd. financial statements to U.S. GAAP results in a debit to Accumulated Depreciation - Machinery of $210,000 and a credit to Depreciation Expense of $210,000.

According to U.S. GAAP rules applied to Teapot Corp., both Accumulated Depreciation - Machinery and Depreciation Expense are overstated by $210,000; therefore, the entry to convert Teapot, Ltd. financial statements to U.S. GAAP results in a debit to Accumulated Depreciation - Machinery of $210,000 and a credit to Depreciation Expense of $210,000.

According to U.S. GAAP rules applied to Teapot Corp., both Accumulated Depreciation - Machinery and Depreciation Expense are overstated by $210,000; therefore, the entry to convert Teapot, Ltd. financial statements to U.S. GAAP results in a debit to Accumulated Depreciation - Machinery of $210,000 and a credit to Depreciation Expense of $210,000.

According to U.S. GAAP rules applied to Teapot Corp., both Accumulated Depreciation - Machinery and Depreciation Expense are overstated by $210,000; therefore, the entry to convert Teapot, Ltd. financial statements to U.S. GAAP results in a debit to Accumulated Depreciation - Machinery of $210,000 and a credit to Depreciation Expense of $210,000.

Learning Objectives

- Learn how to prepare journal entries for the conversion of financial statements from IFRS to U.S. GAAP.

- Understand the corporate policy implications on subsidiary accounting practices, especially concerning depreciation.