Asked by Aufata Aiesi on Jul 07, 2024

Verified

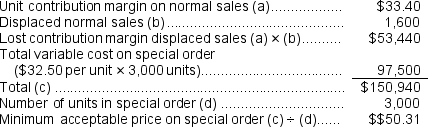

Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1,600 units for regular customers.The minimum acceptable price per unit for the special order is closest to:

A) $62.00 per unit

B) $50.70 per unit

C) $67.80 per unit

D) $50.31 per unit

Idle Capacity

The unused portion of a company's production or service capacity, where resources are available but not being fully utilized.

Minimum Acceptable Price

The lowest price at which a seller is willing to sell a product or service, often determined by costs, market conditions, and profitability goals.

Special Order

A one-time customer order often requiring a deviation from the standard product line or service offerings, potentially at a different pricing or cost structure.

- Identify the minimal acceptable cost for special orders to avert fiscal setbacks.

- Evaluate the financial pros and cons of accepting unique orders given constraints on capacity.

Verified Answer

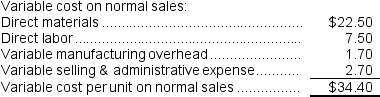

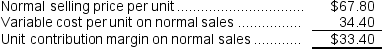

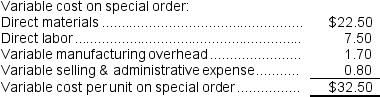

Minimum acceptable price:

Minimum acceptable price:  Reference: CH11-Ref17

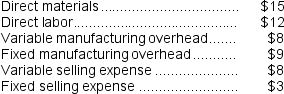

Reference: CH11-Ref17The Melville Corporation produces a single product called a Pong.Melville has the capacity to produce 60,000 Pongs each year.If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:

The regular selling price for one Pong is $80.A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year.If this special order is accepted, the variable selling expense will be reduced by 75%.However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order.This machine will cost $9,000 and it will have no use after the special order is filled.The total fixed manufacturing overhead and selling expenses would be unaffected by this special order.Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80.A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year.If this special order is accepted, the variable selling expense will be reduced by 75%.However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order.This machine will cost $9,000 and it will have no use after the special order is filled.The total fixed manufacturing overhead and selling expenses would be unaffected by this special order.Assume that direct labor is a variable cost.

Learning Objectives

- Identify the minimal acceptable cost for special orders to avert fiscal setbacks.

- Evaluate the financial pros and cons of accepting unique orders given constraints on capacity.

Related questions

Assume Melville Anticipates Selling Only 50,000 Units of Pong to ...

Assume Melville Can Sell 58,000 Units of Pong to Regular ...

The Company Has Received a Special, One-Time-Only Order for 500 ...

Suppose There Is Ample Idle Capacity to Produce the Units ...

Geneva Company Manufactures Dolls That Are Sold to Various Customers ...