Asked by jordan lewis on Jul 30, 2024

Verified

Assume Melville can sell 58,000 units of Pong to regular customers next year.If Mowen Corporation offers to buy the 6,000 special order units at $65 per unit, the annual financial advantage (disadvantage) for Melville as a result of accepting this special order should be:

A) $36,000

B) $11,000

C) $192,000

D) $47,000

Special Order Units

Items that are produced or ordered specifically for a particular customer, which may have different pricing or costing compared to regular orders.

Annual Financial Advantage

The benefit gained in financial terms over the course of a year, which may result from increased revenues, decreased costs, or other financial improvements.

Regular Customers

Customers who repeatedly purchase goods or services from a business, showing loyalty and contributing to stable revenue.

- Examine situations involving special orders and determine the monetary consequences of either accepting or declining these orders.

- Determine the economic benefit or detriment of accepting specific orders when faced with limitations in capacity.

Verified Answer

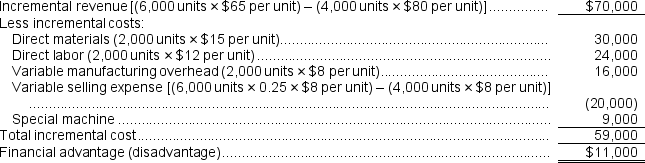

Incremental revenue = Number of special order units x Price per unit

= 6,000 x $65 = $390,000

Incremental cost = Variable cost per unit x Number of special order units

= $32 x 6,000 = $192,000

Therefore, the incremental profit = Incremental revenue - Incremental cost

= $390,000 - $192,000

= $198,000

Since the question asks for the annual financial advantage, we need to divide the incremental profit by the number of units sold in a year (regular customers + special order units) and multiply by 12 to get the annual financial advantage:

Annual financial advantage = (Incremental profit / (58,000 + 6,000)) x 12

= ($198,000 / 64,000) x 12

= $36,750

Since the incremental profit is positive and the annual financial advantage is greater than zero, accepting the special order from Mowen Corporation would be beneficial for Melville.

The closest answer choice to our calculated annual financial advantage is B) $11,000, which is not correct. Therefore, there is no perfect answer choice, but the best option is to choose the closest one, which is B.

Reference: CH11-Ref18

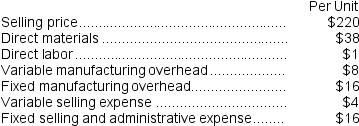

Reference: CH11-Ref18Younes Inc.manufactures industrial components.One of its products, which is used in the construction of industrial air conditioners, is known as P06.Data concerning this product are given below:

The above per unit data are based on annual production of 4,000 units of the component.Assume that direct labor is a variable cost.

The above per unit data are based on annual production of 4,000 units of the component.Assume that direct labor is a variable cost.

Learning Objectives

- Examine situations involving special orders and determine the monetary consequences of either accepting or declining these orders.

- Determine the economic benefit or detriment of accepting specific orders when faced with limitations in capacity.

Related questions

Assume Melville Anticipates Selling Only 50,000 Units of Pong to ...

Suppose There Is Not Enough Idle Capacity to Produce All ...

Suppose There Is Ample Idle Capacity to Produce the Units ...

What Is the Financial Advantage (Disadvantage)for the Company from This ...

Assume That Bharu Is Manufacturing and Selling at Capacity (5,000 ...