Asked by Lauren Stacy on May 27, 2024

Verified

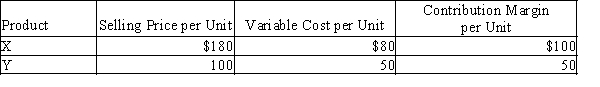

Steven Company has fixed costs of $160,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below.?  The sales mix for products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. If required, round answer to nearest whole number.

The sales mix for products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. If required, round answer to nearest whole number.

Sales Mix

Sales mix is the proportion of different products or services that a company sells, impacting its overall profitability and strategic market positioning.

Contribution Margin

The amount remaining from sales revenue after variable costs have been deducted, indicating the capacity to cover fixed costs and generate profit.

Fixed Costs

Costs that do not vary with the level of production or sales within a certain range, such as rent, salaries, and insurance.

- Calculate when income offsets expenses, in both physical units and dollars, for environments hosting either a single item or an assortment of items.

- Determine the effect of sales mix on a company's profitability and break-even analysis.

Verified Answer

GK

Given KumakoMay 28, 2024

Final Answer :

Unit Selling Price of Sales Mix = $148 ($180 × 60%) + ($100 × 40%)

Unit Variable Cost of Sales Mix = $68 ($80 × 60%) + ($50 × 40%)

Unit Contribution Margin of Sales Mix = $80 ($148 - $68)?

Break-Even Sales (units) = 2,000 ($160,000/$80)

2,000 × 60% = 1,200 units of X

2,000 × 40% = 800 units of Y

Unit Variable Cost of Sales Mix = $68 ($80 × 60%) + ($50 × 40%)

Unit Contribution Margin of Sales Mix = $80 ($148 - $68)?

Break-Even Sales (units) = 2,000 ($160,000/$80)

2,000 × 60% = 1,200 units of X

2,000 × 40% = 800 units of Y

Learning Objectives

- Calculate when income offsets expenses, in both physical units and dollars, for environments hosting either a single item or an assortment of items.

- Determine the effect of sales mix on a company's profitability and break-even analysis.