Asked by Nguyen Hien Minh Quan on Jul 28, 2024

Verified

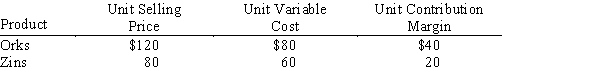

Safari Co. sells two products, orks and zins. Last year, Safari sold 21,000 units of orks and 14,000 units of zins. Related data are as follows:?  ?Calculate the following:

?Calculate the following:

a. Safari Co.'s sales mix

b. Safari Co.'s unit selling price of E

c. Safari Co.'s unit contribution margin of E

d. Safari Co.'s break-even point assuming that last year's fixed costs were $160,000

Sales Mix

The proportion of different products or services that make up the total sales of a company.

Unit Contribution Margin

The amount each unit sold contributes to covering fixed costs and generating profit, calculated by subtracting variable costs per unit from the selling price per unit.

Break-Even Point

The financial point at which total revenues equal total costs and expenses, resulting in no net loss or gain.

- Determine the juncture at which expenses and sales equalize, measured in units and in financial terms, for situations with single or diverse product offerings.

- Identify how a company's profitability and the point of break-even are influenced by its sales mix.

Verified Answer

AC

abiral chitrakarJul 30, 2024

Final Answer :

a. Orks: 21,000/ (21,000 + 14,000) = 60%

Zins: 14,000/(21,000 + 14,000) = 40%

?b. ($120 × 60%) + ($80 × 40%) = $104?

c. [ ($120 - $80) × 60%] + [ ($80 - $60) × 40%] = $32?d. $160,000/$32 = 5,000 units of E

Zins: 14,000/(21,000 + 14,000) = 40%

?b. ($120 × 60%) + ($80 × 40%) = $104?

c. [ ($120 - $80) × 60%] + [ ($80 - $60) × 40%] = $32?d. $160,000/$32 = 5,000 units of E

Learning Objectives

- Determine the juncture at which expenses and sales equalize, measured in units and in financial terms, for situations with single or diverse product offerings.

- Identify how a company's profitability and the point of break-even are influenced by its sales mix.