Asked by Winnie Chiam on Apr 25, 2024

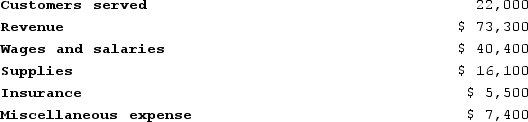

Shaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $3.20 per customer served. Wages and salaries should be $21,000 per month plus $0.80 per customer served. Supplies should be $0.70 per customer served. Insurance should be $5,300 per month. Miscellaneous expenses should be $3,100 per month plus $0.10 per customer served.The company reported the following actual results for October:

Required:Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U).

Required:Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U).

Customers Served

The number of clients or customers who receive services or products from a business within a specified time frame.

Revenue

The total amount of money received by a company for goods sold or services provided during a certain period of time.

Spending Variances

Differences between the actual and budgeted amounts of money spent during a period.

- Ascertain variances between projected and actual budget amounts, assessing if they indicate advantageous or disadvantageous outcomes.

- Investigate fiscal performance by employing flexible budget reports.

- Employ cost and revenue equations to produce budgetary reports.

Learning Objectives

- Ascertain variances between projected and actual budget amounts, assessing if they indicate advantageous or disadvantageous outcomes.

- Investigate fiscal performance by employing flexible budget reports.

- Employ cost and revenue equations to produce budgetary reports.

Related questions

Barrom Memorial Diner Is a Charity Supported by Donations That ...

Poling Clinic Bases Its Budgets on the Activity Measure Patient-Visits ...

Roberds Tech Is a For-Profit Vocational School ...

Wagster Urban Diner Is a Charity Supported by Donations That ...

Arrison Corporation Uses Customers Served as Its Measure of Activity ...