Asked by Gaspar Francisco on Jun 04, 2024

Verified

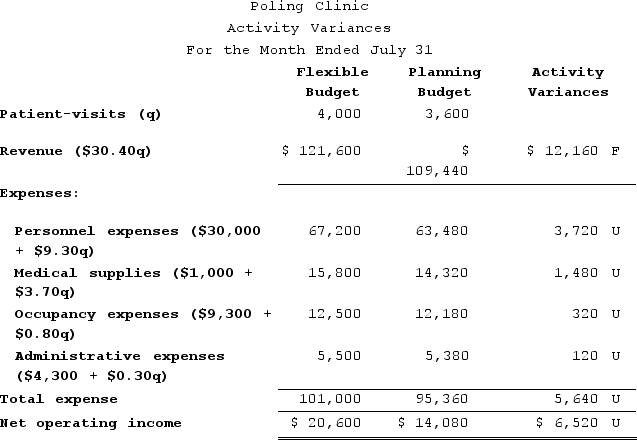

Poling Clinic bases its budgets on the activity measure patient-visits. During July, the clinic planned for 3,600 patient-visits, but its actual level of activity was 4,000 patient-visits. Revenue should be $30.40 per patient-visit. Personnel expenses should be $30,000 per month plus $9.30 per patient-visit. Medical supplies should be $1,000 per month plus $3.70 per patient-visit. Occupancy expenses should be $9,300 per month plus $0.80 per patient-visit. Administrative expenses should be $4,300 per month plus $0.30 per patient-visit.Required:Prepare a report showing the clinic's activity variances for July. Indicate in each case whether the variance is favorable (F) or unfavorable (U).

Activity Variances

The differences between planned activity levels and actual activity levels, and the impact of these differences on a company's costs.

Personnel Expenses

Costs associated with employee compensation, including wages, salaries, benefits, and taxes.

- Examine differences between budget projections and actual financial performance, to ascertain whether they are advantageous or disadvantageous.

- Diagnose economic performance using insights from flexible budget reports.

- Manipulate cost and revenue formulae to yield budgetary compilations.

Verified Answer

BG

Learning Objectives

- Examine differences between budget projections and actual financial performance, to ascertain whether they are advantageous or disadvantageous.

- Diagnose economic performance using insights from flexible budget reports.

- Manipulate cost and revenue formulae to yield budgetary compilations.

Related questions

Morles Jeep Tours Operates Jeep Tours in the Heart of ...

Barrom Memorial Diner Is a Charity Supported by Donations That ...

Sincell Corporation Uses Customers Served as Its Measure of Activity ...

Wagster Urban Diner Is a Charity Supported by Donations That ...

Dilley Clinic Uses Patient-Visits as Its Measure of Activity ...