Asked by Kristine Mae Almodiel on Apr 25, 2024

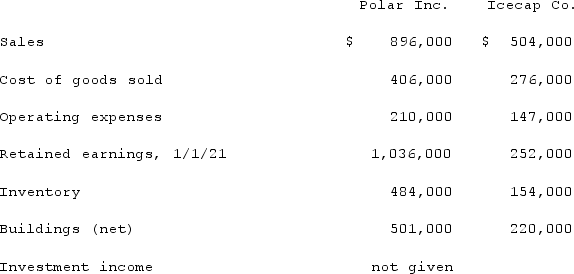

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:  Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Cost of Goods Sold

The financial charges directly linked to the fabrication of products sold by a company, involving both materials and labor input.

Net Income

The profit a company retains after all expenses and taxes have been removed from its revenue.

Inventory

A company's merchandise, raw materials, and finished and unfinished products which have not yet been sold.

- Compute and postpone the gross profit derived from inter-company inventory transactions.

- Formulate financial statements on a consolidated basis, adjusting for intra-entity dealings.

Learning Objectives

- Compute and postpone the gross profit derived from inter-company inventory transactions.

- Formulate financial statements on a consolidated basis, adjusting for intra-entity dealings.