Asked by Katherine Roman on Jul 01, 2024

Verified

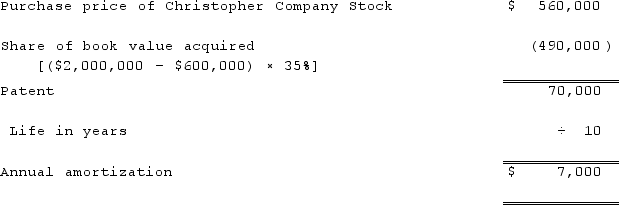

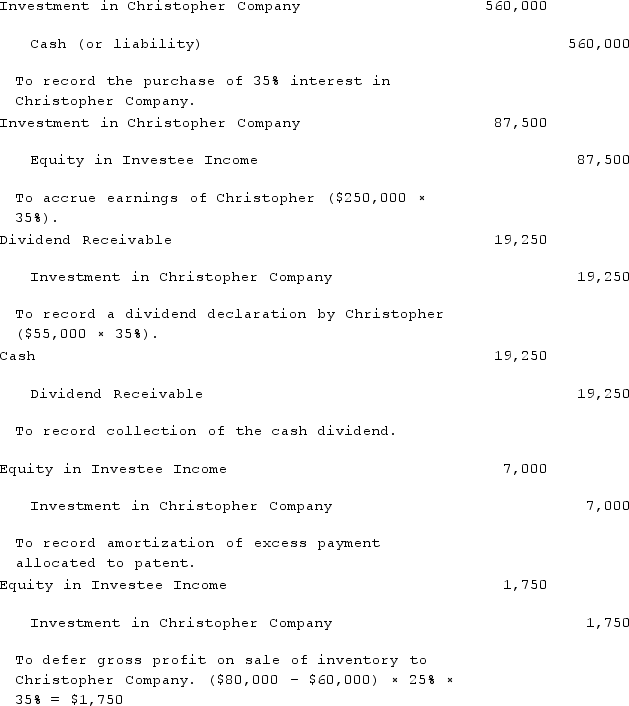

On January 4, 2020, Nelson Corporation purchased 35% of the outstanding voting common stock of Christopher Company for $560,000. This purchase gave Nelson the ability to exercise significant influence over the operating and financial policies of Christopher. On the date of purchase, Christopher's books reported assets of $2,000,000 and liabilities of $600,000. Any excess of cost over book value of Nelson's investment was attributed to a patent with a remaining useful life of seven years. During 2020, Christopher reported net income of $250,000 and declared and paid cash dividends of $55,000. In the following year, 2021, Christopher reported net income of $300,000 and declared and paid cash dividends of $70,000.In 2020, Nelson sold inventory costing $60,000 to Christopher for $80,000. Christopher sold 75% of that inventory to outsiders during 2020 with the remainder being sold in 2021. During 2021, Nelson sold inventory costing $70,000 to Christopher for $100,000. Christopher sold 80% of that inventory to outsiders during 2021.Prepare all of Nelson's journal entries for 2020 to apply the equity method.

Patent

A legal right granted by a government authority that gives an inventor exclusive rights to use, make, and sell an invention for a certain period of time.

Significant Influence

The capacity of an investor to participate in the financial and operating policy decisions of an investee but not control those policies.

- Formulate journal entries concerning equity method investments, including their initial recognition, recording of net income or loss from the investee, and dividends received.

- Ascertain and delay the gross profit derived from inter-entity inventory transactions, ensuring proper recognition in later periods.

Verified Answer

TH

Learning Objectives

- Formulate journal entries concerning equity method investments, including their initial recognition, recording of net income or loss from the investee, and dividends received.

- Ascertain and delay the gross profit derived from inter-entity inventory transactions, ensuring proper recognition in later periods.