Asked by disney. dreams on Jul 25, 2024

Verified

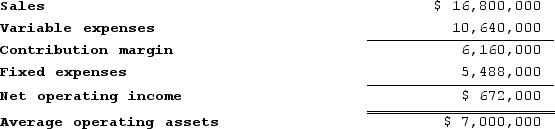

Serie Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

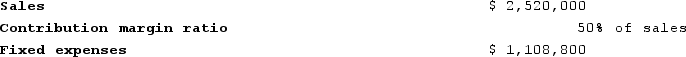

At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 4.9%

B) 4.3%

C) 0.9%

D) 3.5%

Investment Opportunity

A chance to put money into ventures that are expected to yield returns or profits in the future.

Combined Margin

A financial metric that combines various margins (gross, operating, net) to provide insight into a company’s profitability.

- Investigate and ascertain the profit margin among diverse investment choices.

- Gain insight into the effect of sales, contribution margin ratio, and fixed costs on the potential for investments.

Verified Answer

MW

Michael WilliamsJul 28, 2024

Final Answer :

B

Explanation :

To calculate the combined margin for the entire company after pursuing the investment opportunity, we need to add the margin generated from the investment opportunity to the margin generated from last year's operations.

Margin = Operating Income / Revenue

Margin from last year's operations = $186.4 million / $4,020 million = 4.63%

Margin from investment opportunity = ($2,100,000 * 0.22) / $30,000,000 = 1.54%

Combined margin = (186.4 + 2.1*0.22) / (4,020 + 30) = 4.31%

The combined margin for the entire company will be closest to 4.3% (option B).

Margin = Operating Income / Revenue

Margin from last year's operations = $186.4 million / $4,020 million = 4.63%

Margin from investment opportunity = ($2,100,000 * 0.22) / $30,000,000 = 1.54%

Combined margin = (186.4 + 2.1*0.22) / (4,020 + 30) = 4.31%

The combined margin for the entire company will be closest to 4.3% (option B).

Learning Objectives

- Investigate and ascertain the profit margin among diverse investment choices.

- Gain insight into the effect of sales, contribution margin ratio, and fixed costs on the potential for investments.