Asked by Benoit BOUDA on Jul 15, 2024

Verified

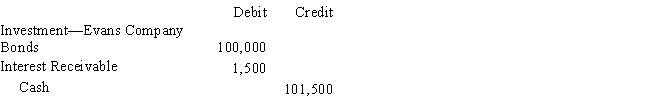

Ruben Company purchased $100,000 of Evans Company bonds at 100 plus $1,500 in accrued interest. The bond interest rate is 8% and interest is paid semiannually. The journal entry to record the purchase would be

A) debit Investment-Evans Company Bonds, $101,500; credit Cash, $101,500

B) debit Investment-Evans Company Bonds, $100,000; credit Interest Revenue, $1,500, and Cash, $98,500

C) debit Investment-Evans Company Bonds, $100,000, and Interest Receivable $1,500; credit Cash $101,500

D) debit Investment-Evans Company Bonds, $100,000; credit Cash $100,000

Accrued Interest

Interest that has been incurred but not yet paid over a specified period, typically relating to bonds or loans.

Bond Interest Rate

The percentage of interest that bond issuers must pay to bondholders, typically expressed as an annual rate.

Semiannually

Occurring twice a year; used to describe the frequency with which certain financial or operational events take place, such as interest payments on bonds.

- Attain proficiency in understanding bond investment accounting, including the mechanisms of purchase, interest income recognition, and sales execution.

Verified Answer

Learning Objectives

- Attain proficiency in understanding bond investment accounting, including the mechanisms of purchase, interest income recognition, and sales execution.

Related questions

The Journal Entry Pierce Will Record on June 30 Will ...

The Journal Entry Pierce Will Record on February 1 Will ...

To Record a Bond Investment Made Between Interest Payment Dates ...

If a Bond Is Purchased at a Discount,then Interest Revenue ...

In 2010, Buckeye Corporation, for the First Time, Invested Some ...

�

�