Asked by Mlebinge Endani on Jun 29, 2024

Verified

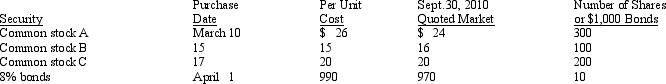

In 2010, Buckeye Corporation, for the first time, invested some idle funds in a variety of securities classified as available for sale, as described below:

The company's year ends on December 31 and the bonds pay interest semiannually on January 1 and July 1.

The company's year ends on December 31 and the bonds pay interest semiannually on January 1 and July 1.

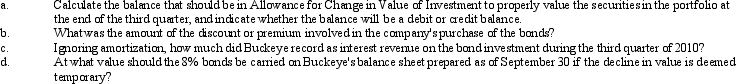

Required:

Answer each of the following questions about Buckeye Corporation's investments:

Available For Sale

A classification for financial assets indicating that they are neither held for trading purposes nor intended to be held to maturity, implying they can be sold to meet liquidity needs or strategic goals.

Idle Funds

Money that is not currently invested or used in transactions, potentially earning no interest or profit.

Semiannually

Occurring or calculated twice a year.

- Comprehend transactions involving bond investments, such as acquisitions at a higher value, accumulated interest, and disposals.

- Understand the categorization, financial recording, and interchange between types for tradable securities.

Verified Answer

ZK

Zybrea KnightJul 06, 2024

Final Answer :

a. $700 \$ 700 $700 credit

b. $100 \$ 100 $100 discount

c. $200(10,000′.08′3/12) \$ 200(10,000 ^\prime .08^\prime 3 / 12) $200(10,000′.08′3/12)

1. $90700 \$ 90700 $90700

b. $100 \$ 100 $100 discount

c. $200(10,000′.08′3/12) \$ 200(10,000 ^\prime .08^\prime 3 / 12) $200(10,000′.08′3/12)

1. $90700 \$ 90700 $90700

Learning Objectives

- Comprehend transactions involving bond investments, such as acquisitions at a higher value, accumulated interest, and disposals.

- Understand the categorization, financial recording, and interchange between types for tradable securities.