Asked by Chris Hillman on May 11, 2024

Verified

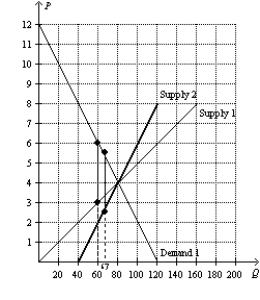

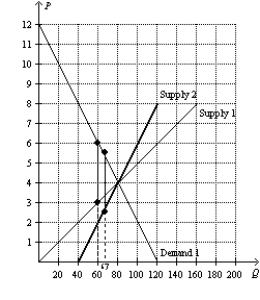

Refer to Figure 8-12. Suppose that Market A is characterized by Demand 1 and Supply 1, and Market B is characterized by Demand 1 and Supply 2. If an identical tax is imposed on each market, the tax will create a larger deadweight loss in which market? Explain.

Deadweight Loss

A loss of economic efficiency that can occur when the equilibrium for a good or service is not achieved or is unattainable.

- Evaluate the repercussions of assorted tax measurements on market consequences, revenue of the government, and opportunity costs.

- Investigate and compare the ramifications of tax imposition on markets possessing varying elasticities of demand and supply.

Verified Answer

TB

Tommy BarronMay 13, 2024

Final Answer :

The deadweight loss will be larger in Market A than Market B because the supply curve is more elastic in Market A than in Market B. The more elastic (inelastic) the supply, the more (less) that quantity decreases when the tax increases the price. The amount by which quantity decreases is the key factor for measuring deadweight loss. The decrease in quantity is the "base" of the deadweight loss triangle. Recall that we measure the area of a triangle as 0.5 x base x height. The height is the amount of the tax, which remains constant in this comparison. The more (less) that quantity responds to a change in price, the larger (smaller) the area of deadweight loss.

The figure below illustrates the area of deadweight loss using a $3 tax in each market.

The figure below illustrates the area of deadweight loss using a $3 tax in each market.

Learning Objectives

- Evaluate the repercussions of assorted tax measurements on market consequences, revenue of the government, and opportunity costs.

- Investigate and compare the ramifications of tax imposition on markets possessing varying elasticities of demand and supply.