Asked by OfficialAuzzi Clitnovici on Jun 16, 2024

Verified

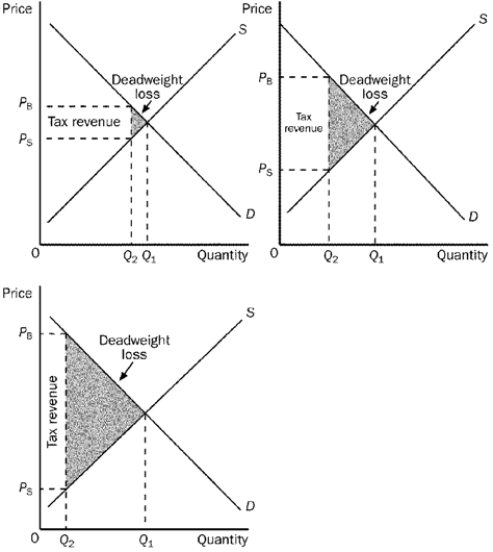

Illustrate on three demand-and-supply graphs how the size of a tax (small, medium and large) can alter total revenue and deadweight loss.

Deadweight Loss

A decline in economic efficiency resulting from the failure to achieve free market equilibrium for a good or service.

Total Revenue

The total amount of money a company generates from its business activities, often calculated by multiplying the price of goods or services by the quantity sold.

- Examine the implications of different tax levels on market dynamics, governmental earnings, and economic inefficiency.

Verified Answer

RL

Learning Objectives

- Examine the implications of different tax levels on market dynamics, governmental earnings, and economic inefficiency.